If you’re in the mortgage industry, you know how competitive it can be to attract and retain clients. That’s where a mortgage marketing agency comes in. These specialized agencies focus on helping mortgage companies and loan officers stand out in a crowded market, generate leads, and ultimately close more deals.

But with so many marketing agencies out there, how do you choose the right one for your business? It’s important to look for an agency that has experience in the mortgage industry and understands the unique challenges and opportunities you face. A good mortgage marketing agency will take the time to learn about your business goals and develop a customized strategy to help you achieve them.

Breaking free from marketing woes is easier said than done, but that’s exactly what mortgage marketing agencies are designed to do. By cutting through the noise and amplifying your message, these agencies can drive real results for mortgage professionals.

What Is a Mortgage Marketing Agency?

Sometimes, mortgage lenders need a little help standing out from the competition to obtain more mortgage leads. That’s where a mortgage marketing agency comes in – a specialized firm that helps loan officers and mortgage companies reel in more leads and clients. Think of them as your secret supporter, helping you grow your business and thrive in a crowded market.

I’ve worked with several mortgage marketing agencies over the years, and I can tell you firsthand – partnering with the right one is a game-changer. They bring a level of expertise and strategy that’s hard to match when you’re trying to DIY your marketing.

Services Offered by Mortgage Marketing Agencies

Imagining a successful mortgage marketing strategy is one thing, but bringing it to life is another. That’s where a mortgage marketing agency comes in. They dive into your unique needs and goals, creating a customized plan that includes a mix of digital marketing tactics, public relations efforts, and social media mastery. By doing so, they help you cut through the noise and connect with the people who matter most – your target audience.

- Website design and development

- Search engine optimization (SEO)

- Content creation (blogs, videos, infographics, etc.)

- Social media management

- Email marketing campaigns

- Paid advertising (Google Ads, Facebook Ads, etc.)

Benefits of Working with a Mortgage Marketing Agency

Partnering with a mortgage marketing agency can take your business to the next level. Here are just a few of the benefits:

- Save time and resources: Marketing is a full-time job. By outsourcing to an agency, you can focus on what you do best – closing deals and serving your clients.

- Tap into industry expertise: Mortgage marketing agencies live and breathe the latest trends, best practices, and regulatory requirements. They can help you navigate the industry and stay ahead of the curve.

- Get measurable results: A good agency will track and measure the success of your campaigns, so you can see exactly what’s working and what’s not. This allows you to make data-driven decisions and optimize your marketing for maximum ROI.

- Scale your business: With a solid marketing strategy in place, you can attract more leads, close more deals, and grow your business faster than you ever could on your own.

How to Choose the Right Mortgage Marketing Agency

Not all mortgage marketing agencies are created equal. To find the right fit for your business, look for an agency that:

- Has a proven track record of success in the mortgage industry.

- Takes the time to understand your unique goals and target audience.

- Offers a customized strategy tailored to your needs.

- Provides clear communication and regular reporting.

- Delivers measurable results that align with your business objectives.

Before signing on the dotted line, I always recommend asking for evidence-based case studies, references, and testimonials that demonstrate an agency’s success. The best agencies will proudly showcase their expertise and willingness to help your business thrive.

Top 10 Mortgage Marketing Strategies Used by Agencies

As a mortgage professional, you know that marketing is essential for growing your business. But with so many strategies to choose from, it can be overwhelming to know where to start. That’s where a mortgage marketing agency comes in.

In today’s mortgage market, it’s not just about filling out an application anymore. Loan officers who lead the pack are masters of lead generation and efficient sales. In this industry-standard benchmarking exercise, we’ll dissect the 10 essential tactics agencies rely on to fuel their loan officers’ growth and profitability.

- Content Marketing: Creating valuable blog posts, videos, and guides that educate and engage potential borrowers.

- Social Media Marketing: Building a strong presence on platforms like Facebook, Instagram, and LinkedIn to connect with your target audience.

- Email Marketing: Nurturing leads and staying top-of-mind with personalized email campaigns.

- Search Engine Optimization (SEO): Optimizing your website and content to rank higher in search results and attract organic traffic.

- Paid Advertising: Leveraging Google Ads, Facebook Ads, and other paid channels to reach a targeted audience and generate leads.

- Video Marketing: Creating engaging video content to showcase your expertise, build trust, and convert leads.

- Referral Marketing: Encouraging satisfied clients to refer their friends and family through incentive programs and easy-to-use referral tools.

- Local SEO: Optimizing your online presence to attract local leads and dominate your market.

- Marketing Automation: Using tools like CRMs and email automation to streamline your marketing efforts and deliver a personalized experience at scale.

- Analytics and Tracking: Measuring the success of your campaigns and making data-driven decisions to optimize your marketing for maximum ROI.

The key is to work with a mortgage marketing agency that can create a customized strategy based on your unique goals, target audience, and budget. With the right mix of tactics and a focus on delivering value to your potential clients, you can take your mortgage business to new heights.

How Mortgage Marketing Agencies Help Generate Quality Leads

Generating quality leads is the lifeblood of any successful mortgage business. But with so much competition out there, it can be challenging to stand out and attract the right prospects. That’s where a mortgage marketing agency can make all the difference.

Targeted Marketing Campaigns

An agency that succeeds in making meaningful connections with customers shares a profound understanding of their needs. To resonate with clients, it’s essential to craft personalized messages that hit the mark, speaking directly to their concerns and desires. This laser-like focus sparks engagement, fostering trust and fuelling the prospect of long-term relationship

The game-changer for agencies is recognizing the inherent emotional investment clients bring to the table. Take, for example, the emotional high-stakes environment of first-time homebuyers. An agency that tends to these anxieties establishes a foundation of trust by offering insightful guidance and demonstrating expertise. From this starting point, long-lasting connections – and fresh mortgage leads – begin to take shape.

Optimizing Landing Pages

Squint-free profitability isn’t guaranteed until your landing pages are tweaked for maximum performance. Designed to guide visitors towards tangible actions, like completing a form or consulting a specialist, these key pages are your strongest advocacy to delivering genuine outcomes.

A mortgage marketing agency can help you create landing pages that are designed to convert. This includes crafting compelling headlines, using persuasive copy, and providing a clear call-to-action. They can also use A/B testing to optimize your pages over time and improve your conversion rates.

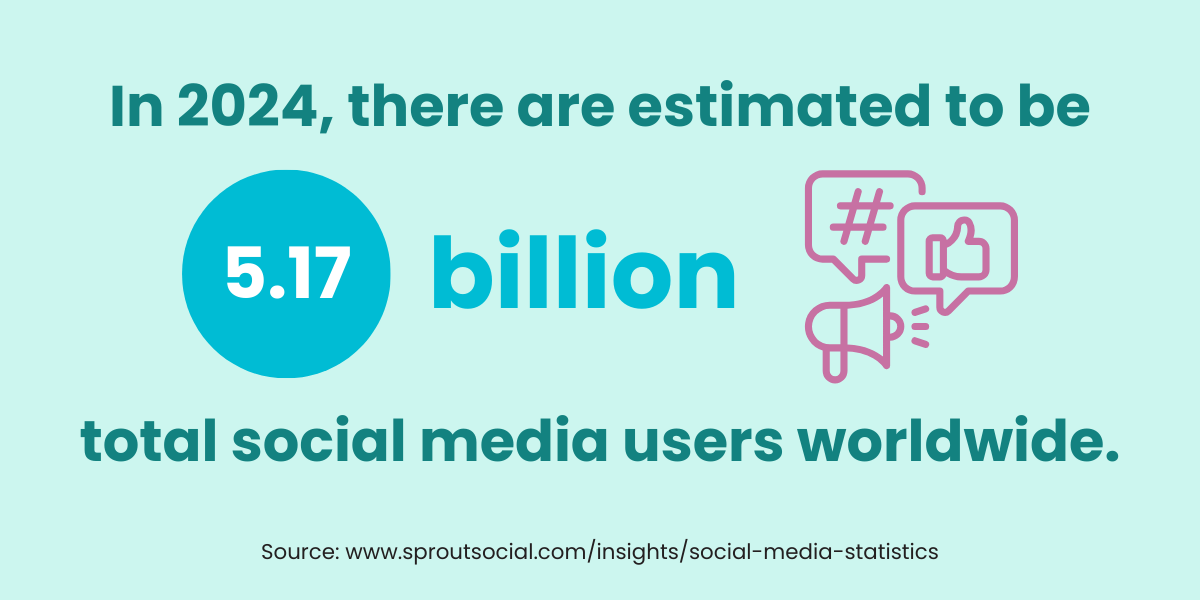

Leveraging Social Media Platforms

Becoming active on social media platforms like Facebook, Instagram, and LinkedIn allows mortgage professionals to expand their online presence and attract potential clients who are already familiar with these platforms.

Social media marketing plays a crucial role in building a strong reputation for a mortgage business. A mortgage marketing agency can help develop a customized social media strategy that highlights our expertise, provides valuable insights, and fosters a connection with our target audience.

- Posting engaging content that educates and informs.

- Running targeted ads to reach new prospects.

- Interacting with followers and building relationships.

- Leveraging social proof, like reviews and testimonials.

Instead of just abandoning your social media leads, invest time and effort in nurturing them, and watch as they transform into loyal clients and brand advocates.

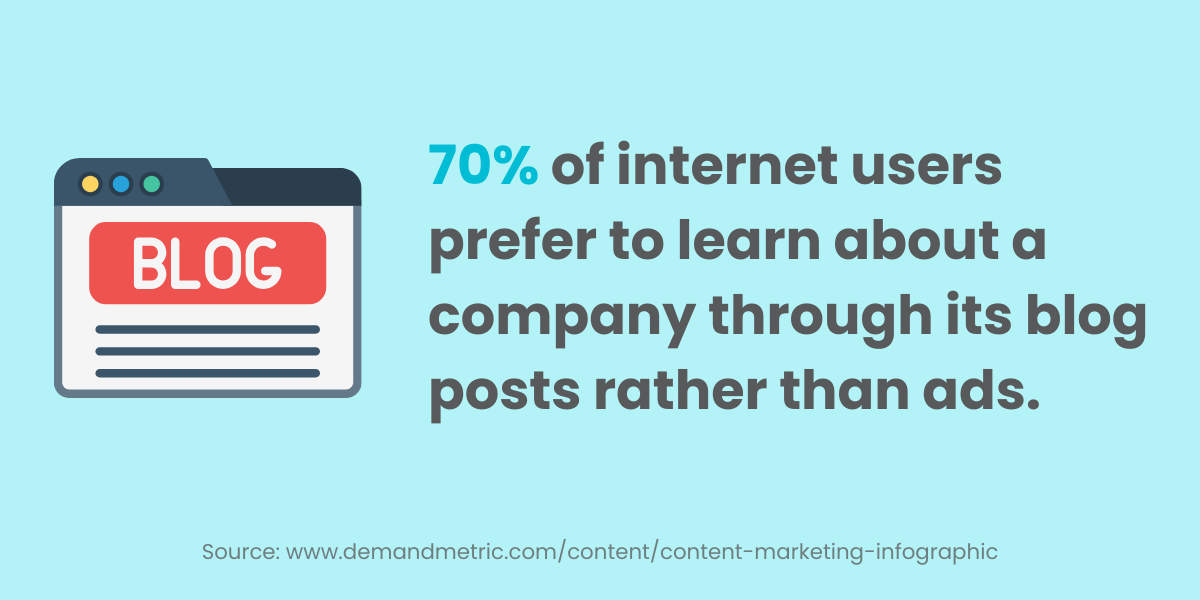

The Role of Content Marketing in Mortgage Marketing

Imagine knowing that the home buying process, or any transaction for that matter, is often shrouded in mystery. Content marketing takes the veil off these intricate steps, making it easier for clients to navigate and trust your expertise.

Types of Content Used in Mortgage Marketing

Data is clear – the most effective mortgage marketing campaigns combine dynamic multimedia content with targeted messaging. Content marketing has never been more important in helping lenders differentiate themselves.

- Blog posts

- Videos

- Infographics

- eBooks and guides

- Case studies

- Podcasts

- Webinars

When you’re talking to readers about mortgages, the way you say it matters just as much as what you say. Use videos and step-by-step guides to break down the process of getting a loan. That way, people who are confused or overwhelmed can finally get a handle on how mortgages really work.

Creating Engaging and Informative Content

Meaningful relationships are built when mortgage marketers share relatable stories that resonate with their audience. By focusing on shared experiences and highlighting remarkable achievements, they create an unforgettable impression.

Sharing tangible examples of how you’ve positively impacted your clients’ lives is a powerful selling point. When you demonstrate your expertise in a down-to-earth manner, you earn the loyalty and enthusiasm of your audience.

Distributing Content Across Channels

Content marketing might grab our attention, yet it’s distribution that keeps us loyal. Connecting with your audience regularly enhances engagement, trust, and in the long run, commitment. Think locally (small business, meetups) and globally (globally shared information links + personal conversations); give these chances.

- Your website and blog

- Social media platforms

- Email newsletters

- Guest posts on industry websites

- Paid advertising channels

Take a dual-pronged approach to increase your content’s visibility. Firstly, share it across multiple channels to broaden your audience. Next, direct traffic back to your website to convert those viewers into valuable leads, thereby growing your mortgage business.

Leveraging Social Media for Mortgage Marketing Success

Mortgage professionals seeking to grow their business know that connecting with potential clients through social media is key. With millions of users on platforms like Facebook, Instagram, TikTok, and LinkedIn, the opportunities to reach and engage your target audience are endless.

Popular Social Media Platforms for Mortgage Marketing

While there are many social media platforms to choose from, some are particularly well-suited for mortgage marketing. These include:

- Facebook: With over 2.7 billion monthly active users, Facebook is a great place to connect with potential homebuyers and share valuable content.

- Instagram: This visual platform is perfect for showcasing beautiful homes, sharing client success stories, and building your brand identity.

- LinkedIn: As a professional networking site, LinkedIn is ideal for connecting with other industry professionals and sharing thought leadership content.

- Twitter: While not as widely used in the mortgage industry, Twitter can be a great place to share quick tips, news updates, and engage in real-time conversations.

Strategies for Building a Strong Social Media Presence

On social media, the old “throw-it-to-the-wall-and-hope-it-sticks” approach is outdated. Aiming for genuine engagement requires you to ditch the status quo and adopt strategies that drive meaningful connections with your audience.

- Develop a content calendar: Plan out your social media content in advance to ensure a consistent posting schedule and mix of content types.

- Use eye-catching visuals: Posts with images or videos tend to perform better than text-only updates. Use high-quality visuals to grab attention and showcase your brand.

- Engage with your audience: Respond to comments and messages, ask questions, and encourage feedback to build relationships with your followers.

- Leverage hashtags: Use relevant hashtags to make your content more discoverable and join industry conversations.

- Run targeted ads: Use social media advertising tools to reach a highly targeted audience based on demographics, interests, and behaviors.

Engaging with Your Target Audience on Social Media

One of the biggest benefits of social media is the ability to engage directly with your target audience. This means going beyond just broadcasting content, and instead having meaningful conversations and building relationships.

Some ways to engage with your audience on social media include:

- Responding to comments and messages in a timely manner.

- Asking for feedback and opinions on industry topics.

- Sharing user-generated content, like client testimonials or photos.

- Running contests or giveaways to encourage interaction.

- Joining relevant groups and participating in discussions.

By consistently engaging with your audience and providing value, you can build trust, establish your expertise, and ultimately drive more leads and sales for your mortgage business.

The Importance of SEO in Mortgage Marketing

Search engine optimization (SEO) is a critical component of any successful mortgage marketing strategy. By optimizing your website and content for search engines like Google, you can attract more organic traffic, generate high-quality leads, and ultimately grow your business.

On-Page SEO Techniques

In today’s digital marketplace, mortgage specialists need a premier search engine placement. on-page SEO best practices ensure effectiveness, engendering fluid on-site transitions, effortless crawl-capacity, heading with strategic subheadings, and authentic alt-text descriptions on high-definition images. As your window into comprehensive listings remains wide open, organic fame won.

- Keyword research: Identify the keywords and phrases that your target audience is searching for, and optimize your content around those terms.

- Title tags and meta descriptions: Write compelling title tags and meta descriptions that accurately reflect your page content and entice users to click through from search results.

- Header tags: Use header tags (H1, H2, etc.) to structure your content and signal to search engines what your page is about.

- Internal linking: Link to other relevant pages on your website to help search engines understand your site structure and distribute link equity.

- Content optimization: Create high-quality, informative content that addresses your target audience’s needs and includes relevant keywords.

Off-Page SEO Strategies

Off-page SEO refers to the tactics you can use outside of your own website to improve your search engine rankings. Some key off-page SEO strategies for mortgage professionals include:

- Link building: Acquire high-quality backlinks from other reputable websites in your industry to signal to search engines that your site is trustworthy and authoritative.

- Local SEO: Optimize your Google My Business listing and other local directories to improve your visibility in local search results.

- Social media: Share your content on social media platforms to drive traffic back to your website and build your brand authority.

- Guest posting: Contribute guest posts to other industry blogs and websites to build backlinks and establish yourself as a thought leader.

Measuring SEO Success

There’s no single formula for achieving SEO success in the mortgage industry. Instead, effective professionals focus on tracking and optimizing key metrics that drive conversions and incremental revenue growth:

- Organic traffic: The number of visitors coming to your website from organic search results.

- Keyword rankings: The position of your website in search results for target keywords.

- Backlinks: The number and quality of external websites linking back to your site.

- Conversion rate: The percentage of website visitors who take a desired action, like filling out a lead form or scheduling a consultation.

Measuring the Success of Your Mortgage Marketing Efforts

To unlock your successful marketing results in every mortgage professional’s quest resides tracking effectiveness of every effort. The ultimate question lies not only in establishing leads, increasing your presence, but knowing what shapes sales and final outcomes isn’t just that much a number game.

Key Performance Indicators (KPIs) to Track

Sending strong mortgage marketing campaigns relies on pinpointing the vital signs that inspire sales. Whether it’s gauging website traffic, conversion rates, or measuring client satisfaction, aligning your metrics to these business-building barometers will sharpen your campaign’s impact.

- Lead generation: The number of new leads generated from your marketing efforts, such as form submissions or phone calls.

- Conversion rate: The percentage of leads that convert into actual clients or closed loans.

- Cost per lead: The amount of money you’re spending on marketing divided by the number of leads generated.

- Return on investment (ROI): The amount of revenue generated from your marketing efforts compared to the amount spent.

Partner with a mortgage marketing agency to amplify your lead generation and boost business growth, outsourcing marketing efforts to experts who know the industry inside out.

Conclusion

Working with a mortgage marketing agency can be a game-changer for your business. By leveraging their expertise and resources, you can attract more leads, build stronger relationships with clients, and ultimately close more deals.

But it’s not just about the bottom line. A good mortgage marketing agency will also help you build a strong brand and reputation in the industry. They’ll work with you to create compelling content, develop a cohesive marketing strategy, and position your business as a trusted resource for homebuyers and homeowners alike.

So if you’re a mortgage lender that’s ready to take your business to the next level, consider partnering with a mortgage marketing agency. With the right team in your corner, there’s no limit to what you can achieve.