SEO for Mortgage Lenders means showing up when borrowers search online for current rates, calculators, and programs, before they ever fill out a form or talk to a loan officer. Most lenders don’t understand how search engine optimization works, so instead of building visibility, they buy leads. That decision quietly hands millions of high-intent borrower searches every month to brands like Rocket Mortgage, whose visibility now extends beyond Google into AI search results, summaries, and recommendations.

In an AI-driven search landscape, being absent from organic results doesn’t just mean fewer clicks, it means being invisible where borrowers are actually making decisions.

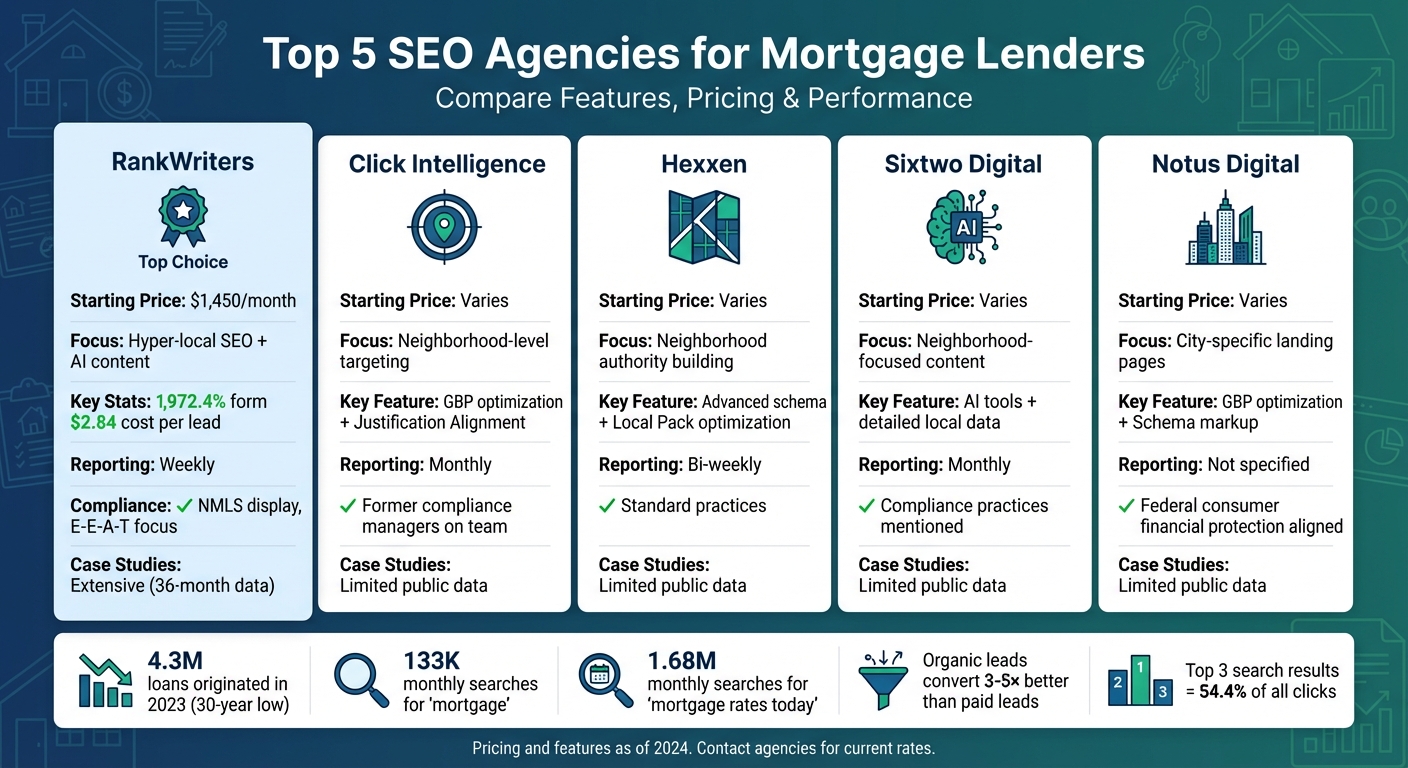

This article reviews five SEO agencies that specialize in helping mortgage lenders improve visibility, meet compliance requirements, and generate leads through organic search. Here’s a quick overview of the agencies:

- RankWriters: Builds lead generation flywheels, writes content that fuels traditional and AI search, and is compliant. Transparent pricing starts at $1,450/month.

- Click Intelligence: Specializes in neighborhood-level targeting and Google Business Profile (GBP) management.

- Hexxen: Builds neighborhood-specific authority with tailored pages and advanced local SEO techniques.

- Sixtwo Digital: Uses AI tools for neighborhood-focused SEO and prioritizes detailed local content.

- Notus Digital: Optimizes GBP and creates city-specific landing pages for local search rankings.

Each agency offers unique strengths, from local SEO expertise to AI-driven strategies, ensuring mortgage lenders can find the right fit for their goals and budget.

Top 5 SEO Agencies for Mortgage Lenders: Features, Pricing & Results Comparison

Quick Comparison

| Agency | Focus Area | Starting Price | Key Features | Reporting |

|---|---|---|---|---|

| RankWriters | Compounding lead generation flywheel | $1,450/month | High-quality content, industry expertise, demonstrated success | Constant |

| Click Intelligence | Neighborhood-level targeting | Varies | GBP optimization, compliance oversight | Monthly |

| Hexxen | Neighborhood authority | Varies | Advanced schema, Local Pack optimization | Bi-weekly |

| Sixtwo Digital | Neighborhood-focused content | Varies | AI tools, detailed local data integration | Monthly |

| Notus Digital | City-specific landing pages | Varies | GBP optimization, compliance-aligned content | Not specified |

For mortgage lenders, SEO isn’t just about ranking – it’s about driving qualified leads. With the right agency and proven mortgage marketing strategies, you create a compounding lead generation flywheel. These leads have a higher closing percentage, lower cost, and will help you outperform competitors in a challenging market.

1. RankWriters

RankWriters stands out as a top-tier agency specializing in SEO for mortgage lenders, combining decades of mortgage marketing & lead generation experience with consistent results. One standout campaign between 2022 and 2025 saw impressive growth: monthly organic traffic jumped from 11,683 to 108,284, website form submissions soared from 660 to 13,678, phone calls increased from 181 to 5,201, and lead costs were reduced to just $2.84 per lead[2].

Local SEO for Loan Officers

RankWriters has mastered the art of local SEO, honing in on hyper-local keywords like “First-time homebuyer loans in [City]” or “VA home loan rates in [County].” By creating location-specific pages and community-focused FAQs, they help mortgage lenders optimize their reach at the branch level, whether the focus is local, regional, or national.

Tools for Lead Generation

Their content strategy is tailored to every stage of the mortgage funnel. For example, top-of-funnel educational posts address questions like “How to FHA loans work?” while bottom-of-funnel content targets intent-driven searches such as “Refinance a VA Loan in Westmoreland County.” RankWriters also integrates generative search optimization to ensure their clients’ content is prominently featured on platforms like ChatGPT, Perplexity, and Google’s Search Generative Experience (SGE). In fact, one client saw their brand mentions in Google’s AI Overview grow from zero to over 5,400 in just 15 months[2]. To maximize exposure, they repurpose blog content for use across social media, email campaigns, and video platforms.

Proven Results Through Case Studies

RankWriters’ case studies highlight their ability to deliver measurable results. For instance, one 36-month campaign for a mortgage lender revealed that organic search traffic outperformed paid search by nearly three times and drove almost ten times more traffic than display ads[2]. Their pricing is transparent, starting at $1,450 per month for one optimized post per week, with options scaling up to $3,950 per month for four weekly posts. The more frequent the posts, the lower the cost per post, dropping from $362.50 to $247.00 as volume increases.

Compliance-Driven Content

The mortgage industry comes with its own set of strict regulations, and RankWriters ensures all content is both compliant and competitive. Their team carefully crafts educational material on loan products, rates, and qualifications to meet industry standards while achieving high rankings. This attention to compliance helps avoid costly mistakes that can occur when working with agencies unfamiliar with the nuances of mortgage lending regulations.

2. Click Intelligence

Click Intelligence takes local SEO to the next level by focusing on neighborhoods instead of just cities. They create mortgage marketing content tailored to specific neighborhoods, incorporating data like school ratings, crime statistics, and property appreciation rates[5]. This detailed approach helps mortgage lenders connect with borrowers who are searching for financing options tailored to their immediate community.

Local SEO Approach

Click Intelligence doesn’t stop at hyper-local content. They also enhance local visibility by managing Google Business Profiles (GBP) with precision. This includes optimizing categories, defining service areas, and regularly updating the profile with posts, Q&As, and reviews[6][4]. Their “Justification Alignment” strategy is key – by aligning on-site content with GBP services, they trigger Google’s validation phrases like “Their website mentions…” This alignment helps lenders show up in local search results for terms like “mortgage broker near me.”

Compliance Expertise

Given the tight regulations in the mortgage industry, Click Intelligence ensures all content is compliant with federal consumer financial protection laws. They have former compliance managers from mortgage brokerages on their team to oversee these efforts[7]. They also integrate with mortgage-focused CRM platforms like Total Expert and Surefire, which streamline compliance workflows through automation.

Reporting and Metrics

Click Intelligence tracks performance through detailed reporting on metrics like organic traffic, keyword rankings, conversion rates, lead volume, cost per lead, and lead-to-application rates[8][9][10]. Using tools like Google Analytics 4 and Google Search Console, they measure how SEO efforts contribute to loan applications and revenue. This data-driven approach ensures their strategies deliver measurable results for mortgage lenders.

3. Hexxen

Hexxen takes a unique approach to local SEO by zeroing in on hyper-local strategies. Instead of relying on broad geographic terms, they create tailored neighborhood pages aimed at outranking competitors using generic content. This method helps mortgage lenders build “neighborhood authority”, making their services more relevant to local audiences and boosting search engine performance. It’s a highly focused strategy that integrates seamlessly with broader local optimization efforts.

Local SEO Expertise

Hexxen’s expertise shines in targeting the Local Pack – the coveted top map results on Google. They go beyond the basics by using advanced local schema markup to improve visibility. Their approach includes managing Google Business Profile details meticulously: refining categories, defining precise service areas, and keeping posts, Q&As, and reviews up to date. By combining these efforts with local schema markup, they ensure search engines prominently display location-specific information, giving their clients a competitive edge in local search results.

sbb-itb-16c0a3c

4. Sixtwo Digital

Sixtwo Digital takes a unique approach to SEO by honing in on hyper-local targeting rather than casting a wide net with city-level keywords. Instead of using broader terms like “Chicago mortgage lender”, they focus on specific neighborhood-based phrases such as “Lincoln Park home loans” or “Wicker Park mortgage rates.” This strategy allows them to tap into highly targeted traffic from individual neighborhoods, setting them apart in a competitive market.

Focused Local SEO

To make neighborhood pages stand out, Sixtwo Digital incorporates detailed, localized information. They include specifics like school performance data and property market trends for each area, creating content that feels personalized and relevant. For example, they might highlight down payment assistance programs tailored to a particular neighborhood [10]. This approach ensures that when potential borrowers search for mortgage-related information in a specific area, they find content that directly addresses their needs.

AI-Powered Lead Generation

Sixtwo Digital also uses AI-driven tools to enhance neighborhood-focused content. By integrating insights from platforms like ChatGPT and Perplexity, they align their content with local search patterns. This not only improves the relevance of their pages but also opens up new opportunities for marketing for mortgage companies, as these tools are becoming a key part of how people research mortgage options.

Transparent Reporting

Rounding out their strategy, Sixtwo Digital emphasizes clear and consistent reporting. They provide regular updates on performance metrics, focusing on local market data and lead generation results [11]. This level of transparency keeps lenders informed about campaign progress and ensures they can track the effectiveness of their neighborhood-specific strategies.

5. Notus Digital

Notus Digital focuses on optimizing Google Business Profiles and creating city-specific landing pages to enhance local search rankings. Their approach zeroes in on the Local Pack – the prominent map results displayed during location-based searches. By refining business categories, aligning service areas, and keeping a steady stream of reviews, they help businesses secure top-tier visibility [6][3]. This strategy lays a strong foundation for effective local SEO, as explained below.

Local SEO Expertise

Notus Digital develops city-specific landing pages designed to rank for localized keywords like “mortgage broker in [City].” These pages are packed with relevant details such as localized data, FAQs, and team NMLS information [6][1][4]. To further boost visibility, they implement Schema markup, enabling search engines to better showcase mortgage-specific details in local search results.

Commitment to Compliance

Understanding the importance of regulatory adherence, Notus Digital crafts SEO content that aligns with federal consumer financial protection laws. Their content strategy carefully addresses complex financial terms, ensuring that all fine print is handled with precision [7]. This meticulous approach not only helps lenders maintain legal compliance but also preserves their presence in search results without risking penalties.

Pros and Cons Comparison

This section breaks down each agency’s strengths and limitations to provide a clear picture of their offerings. Every agency brings something different to the table when it comes to mortgage SEO, combining local market expertise with tools for lead generation. For example, RankWriters sets itself apart with transparent pricing starting at $1,450/month and weekly performance reviews. Their strategy covers local, regional, and national SEO, leveraging branch-level expertise and a powerful lead-generation system optimized for both traditional search engines and AI platforms like ChatGPT and Perplexity.

Other agencies, such as Click Intelligence, Hexxen, Sixtwo Digital, and Notus Digital, focus on specific areas like technical audits, local map pack optimization, or city-specific landing pages. However, compared to the in-depth case studies offered by RankWriters, the available data for these agencies is more limited. Additionally, while some agencies charge as much as $5,000/month[5], RankWriters offers straightforward, upfront pricing.

Here’s a quick comparison of their key features:

| Agency | Geographic SEO Strength | Lead Generation Tools | Compliance Focus | Reporting Frequency | Industry Case Studies |

|---|---|---|---|---|---|

| RankWriters | Local, regional, national focus; deep industry expertise | AI search optimization, content pillars, conversion-focused content | YMYL deference, NMLS display, E-E-A-T focus, and regulatory adherence | Constant | From 0 to 5,000+ AI mentions per month in 15 months |

| Click Intelligence | City-level targeting | Standard SEO tools | Basic compliance | Monthly | Limited public data |

| Hexxen | Regional focus | Content-driven approach | Standard practices | Bi-weekly | Limited public data |

| Sixtwo Digital | Technical SEO audits | Backlink-focused campaigns | Compliance practices mentioned | Monthly | Limited public data |

| Notus Digital | Google Business Profile optimization; Local Pack focus | City-specific landing pages | Aligned with federal consumer financial protection | Not specified | Limited public data |

RankWriters takes the lead with constant, transparent performance updates, regular content optimization to boost performance, and a content pillar strategy[2], offering the most frequent and transparent reporting. This level of detail is vital for tracking critical metrics like organic lead volume, cost per lead, and conversions in real time. Given that organic leads tend to convert 3–5× better than paid leads[2], having a data-driven SEO partner like RankWriters can make a significant difference in long-term mortgage lead generation.

Conclusion

Choosing the right SEO partner is crucial for aligning with your growth objectives. For local lenders, it’s essential to work with professionals skilled in Google Business Profile management and hyper-local, conversion-focused content. On the other hand, regional and national lenders require partners capable of delivering 3–4 optimized posts per week while utilizing AI-driven search optimization techniques.

RankWriters stands out with transparent pricing (starting at $1,450/month) and a track record of success. Their comprehensive approach covers local, regional, and national SEO, optimizing for both traditional search engines and AI platforms.

The effectiveness of organic strategies cannot be overstated. Organic leads convert 3–5 times better than paid ones, and the top three search results account for 54.4% of clicks [2][5]. By treating SEO as a long-term strategy, businesses can drive consistent lead generation while tracking meaningful metrics – from pre-qualifications to funded loans.

To achieve these results, it’s vital to collaborate with agencies that combine compliance expertise and local insights. Seek partners who excel in mortgage compliance, provide branch-level support, and back their strategies with measurable outcomes. As Greg Schatz from Allied Lending puts it:

“Ranking isn’t the primary goal – generating qualified leads is the goal.”

FAQs

Can SEO help mid-size mortgage lenders compete with larger national companies?

SEO creates a more even playing field so mid-size lenders can go head-to-head with big national players by appearing in traditional and AI search results.

By targeting a combination of low-intent and high-intent keywords, crafting pillar and cluster content, and fine-tuning Google Business Profiles, lenders can connect directly with borrowers actively looking for loans.

A well-executed, data-backed SEO strategy can also help lenders establish a steady flow of leads. This involves technical improvements, boosting relevance, and creating content aimed at driving conversions.

With the right tactics, mortgage lenders can attract more qualified leads and achieve sustainable growth – even when competing with larger, better-funded companies.

What should mortgage lenders look for in an SEO agency?

When selecting an SEO agency, relevant industry experience is essential, specifically a meaningful understanding of compliance.

Lenders should also ask about the agency’s data-driven strategies to address every stage of the mortgage sales funnel – from building awareness to generating leads. It’s essential to partner with an agency that specializes in local, regional, and national SEO, offering tailored support for individual branches while delivering measurable outcomes.

Here are some key traits to look for:

- Transparent pricing to set clear expectations upfront

- A strong track record in producing high-quality, targeted content that boosts search rankings and builds borrower trust

- Case studies demonstrating success in driving long-term growth through SEO, AEO, and GEO campaigns

A great agency will also utilize local SEO techniques, such as optimizing Google My Business profiles and crafting localized content, to help you connect with borrowers in specific areas. The ultimate aim should be to create a sustainable lead generation system that grows steadily and delivers consistent results over time.

Why is SEO compliance critical for mortgage lenders?

SEO compliance plays a critical role for mortgage lenders, as it ensures they meet both industry regulations and search engine guidelines. This dual compliance helps maintain trust with search engines and potential clients alike. Failing to adhere to these standards can result in penalties, decreased online visibility, or even legal complications – serious concerns in the tightly regulated mortgage sector.

By sticking to compliant SEO practices, mortgage lenders safeguard their reputation, strengthen consumer confidence, and establish a reliable foundation for improving search rankings. This strategy not only supports steady growth but also ensures marketing efforts remain aligned with legal and ethical expectations.