Credit unions often struggle to compete with large banks and fintechs online. But SEO offers an effective way to improve visibility and attract new members. Here’s why it matters:

- 68% of online experiences begin with a search engine, and 78% of local searches lead to offline actions, like visiting a branch.

- Credit unions that rank in the top five search results capture most clicks, while those lower risk being ignored.

- SEO strategies like local optimization, content tailored to members’ needs, and online reviews can drive traffic and increase membership.

While SEO takes time to show results, it provides long-lasting benefits. By focusing on local SEO, creating helpful content, and maintaining a strong online presence, credit unions can stand out in a crowded digital space.

How SEO Works for Credit Unions

SEO helps credit union websites secure top spots in search results by implementing financial services SEO strategies. Imagine someone searching for “auto loan rates near me” or “best savings account in [City].” A properly optimized website ensures your credit union shows up exactly when and where potential members are looking.

“SEO can be the best marketing investment a credit union makes over the long term. Over time, returns on SEO investments grow and grow.” [1]

Now, let’s dive into how local SEO can harness your credit union’s community connections to enhance online visibility.

Using Local SEO to Reach Community Members

Credit unions have a unique edge over national banks: strong local ties. Local SEO capitalizes on this by making sure your credit union appears prominently in searches tied to specific areas.

It all starts with your Google Business Profile (GBP). Claim and verify profiles for every branch, using precise categories like “Credit Union”, “Loan Agency”, and “Mortgage Lender” to align with varied search queries [6][1]. For each branch, create dedicated web pages that feature local photos, branch-specific details, embedded Google Maps, and descriptions of the services available at that location [6][7]. If you serve nearby cities without physical branches, consider creating service-area pages to capture regional search traffic [6].

Online reviews are another key piece of the puzzle. 84% of people trust online reviews as much as personal recommendations [4]. Encourage members to leave reviews for specific branches through email campaigns or in-branch signage. Respond to every review – whether it’s glowing or critical – to show your dedication to member service and improve your local ranking signals [6][1].

Calculating SEO Return on Investment

Local SEO provides measurable benefits, but calculating the return on your SEO investment can further highlight its value. This is especially important when addressing the visibility challenges credit unions face.

SEO offers a cost-effective way to drive traffic compared to PPC campaigns, where financial keywords can cost anywhere from $30 to $150 per click [3] without any guarantee of conversions. For example, Canvas Credit Union saw its conversion-focused organic traffic grow by 5X [1].

What makes SEO stand out is its long-term impact. Unlike PPC, where results disappear the moment you stop spending, SEO continues to generate traffic and applications well beyond the initial investment. While significant traffic increases typically occur within 3 to 6 months of consistent optimization [1], the true value builds over time as your domain authority grows and your content library expands. To measure the real impact, track specific goals like new account openings, loan applications, and membership growth driven by organic search traffic [1][5].

sbb-itb-16c0a3c

SEO Strategies That Work for Credit Unions

To maximize the benefits of SEO, credit unions can use a combination of local and content-focused strategies. These approaches are designed to strengthen their online presence and connect with both current and potential members.

Ranking Higher in Local Search Results

A strong local presence is essential. Start by optimizing your Google Business Profile (GBP) with accurate categories and structured local pages. For branches, create dedicated pages that include photos, operating hours, local maps, and schema markup to improve visibility in search results [6]. If you serve areas without physical branches, develop service-area pages targeting geographic keywords like “best first-time mortgages in [City]” to attract local search traffic [6][8].

Building local authority is another key tactic. You can earn backlinks from community organizations by sponsoring events, joining the local chamber of commerce, or funding scholarships and grants. These activities reinforce the community connection, which 82% of credit union members value [7]. Additionally, keep an eye on competitors – report any “black hat” tactics, such as keyword stuffing in GBP business names, to protect your rankings in the Map Pack [6].

Of course, technical optimization is only part of the equation. Your content must also address the specific needs of your members.

Creating Content That Answers Member Questions

Financial content falls under Google’s “Your Money or Your Life” (YMYL) category, which means it needs to meet high standards for accuracy and trust. This provides an opportunity for credit unions to stand out by offering well-researched, member-focused information.

Focus on long-tail keywords – specific phrases that target high-intent searches. For example, instead of competing for a broad term like “mortgages”, aim for phrases such as “best first-time mortgages in Oregon” or “how to refinance a car loan with bad credit.” Long-tail keywords make up 70% of all web searches and help attract more qualified leads [7].

Use the “Four Cs” approach: Competition, Customer, Customization, and Convenience [8]. Create comparison pages (e.g., “Traditional IRA vs. Roth IRA”) and detailed guides for significant financial decisions like buying a first home or consolidating debt [3].

Interactive tools like loan calculators, savings growth projections, and financial checklists are also valuable. These tools not only help members but also show search engines that your content is practical and engaging [3][2].

To build trust, highlight the expertise of your content creators. Include detailed author profiles showcasing credentials such as CFA, CFP, or CPA. Use schema markup to tag authors with structured data like jobTitle, alumniOf, and knowsAbout. This helps search engines confirm their qualifications and supports the E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness) standards that Google prioritizes for financial content [3].

Using Online Reviews to Build Credibility

Online reviews act as digital word-of-mouth, influencing both search rankings and member decisions. With 84% of people trusting online reviews as much as personal recommendations [4], a strong review strategy is crucial.

Google uses review count and average rating as factors when determining which businesses appear in the local Map Pack [9]. To encourage reviews, send automated requests via email or SMS after positive interactions, such as loan approvals or account openings. You can also place review prompts on branch signage and receipts [6][9].

Responding to reviews is equally important. Thank members for positive feedback and address negative reviews by acknowledging concerns and offering solutions – while taking the conversation offline when necessary [6][9]. Positive reviews can also be repurposed as testimonials on your website, helping to boost conversion rates [4][9]. Regularly monitor your listings to correct any inaccurate “suggested edits” to your business information [6].

Keep in mind that 78% of local searches lead to an offline action within 24 hours. A strong review profile can make all the difference in converting search interest into in-person visits [2][9].

New Developments in SEO for Credit Unions

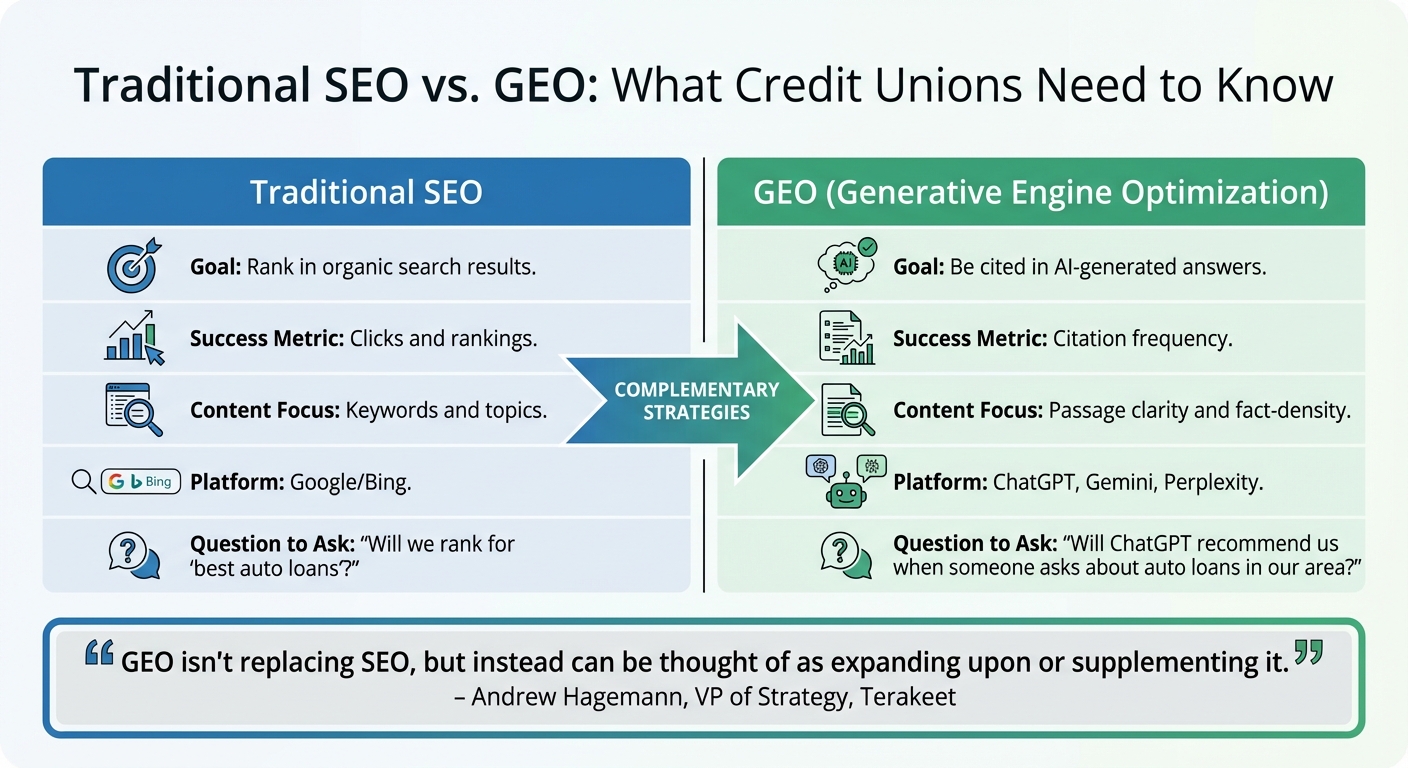

Traditional SEO vs GEO for Credit Unions Comparison Chart

As the digital world evolves, credit unions need to rethink their SEO strategies to keep up with the rise of AI-driven search results. The way people find information online is shifting – search engines like Google are increasingly offering direct, AI-generated answers instead of just a list of links. For example, Google’s AI Overviews now appear in over half of search results. When they do, the top organic result can lose about 33% of its clicks [10][12]. Platforms like ChatGPT and Perplexity are also changing how users search for financial information, leading to what experts call “the great decoupling.” Your credit union might appear in more searches, but fewer users are clicking through to your website [10]. Even more striking, 99% of users who see AI-generated summaries don’t click on any of the cited sources [12].

What does this mean for credit unions? Traditional SEO isn’t enough anymore. It’s not just about ranking high in search results – it’s about being included and recommended within those AI-generated answers. This shift calls for a dual approach: maintaining strong traditional SEO while adopting strategies tailored to AI-driven search.

Adapting to AI-Generated Search Results

AI search engines operate differently from traditional ones, prioritizing multiple authority signals. To get your credit union mentioned, it’s not enough to have one well-optimized page. AI tools favor institutions that appear across high-authority sources like local news outlets, industry publications, and community forums [11]. Regularly check your AI visibility by testing platforms like ChatGPT, Gemini, and Perplexity. Ask questions like, “Which credit union in [your city] offers the best first-time homebuyer program?” If your credit union isn’t being cited, analyze which competitors are showing up and where the AI is pulling its information from [10][11].

To improve your chances, structure your content so it’s easy for AI to extract relevant information. Use clear headings and concise answers. AI models don’t read entire pages – they focus on specific chunks of content. Start each section with a 40–60 word answer to a key question, then provide more details. For instance, instead of burying loan terms deep in a paragraph, highlight them in a clearly labeled section.

Schema markup is another powerful tool. Studies show that structured content with clear headings, FAQs, and schema markup has a strong correlation with being included in ChatGPT results [11].

But don’t stop at your own website. Build your presence on external platforms. Join Reddit discussions about local finance, contribute expert opinions to community news outlets, and seek mentions in industry publications. These third-party references act as trust signals that AI models use when deciding which organizations to recommend [11].

“Search is changing – again… It’s about being recognized, trusted, and referenced in a world where answers are aggregated by machines, not browsed by humans.” – Chris Lister, WebRanking [10]

Adding GEO to Your SEO Strategy

To complement your AI-focused efforts, consider incorporating Generative Engine Optimization (GEO). GEO is about structuring and distributing your content so that AI platforms trust it, select it, and cite it in their answers [13][14]. While traditional SEO focuses on ranking within search results, GEO aims to make your credit union the default cited answer in AI-generated responses [14].

Your existing SEO practices – like clean site architecture, fast loading times, and mobile optimization – are still important. AI crawlers need to access and interpret your content effectively [10]. However, GEO shifts the focus. Instead of asking, “Will we rank for ‘best auto loans’?” the question becomes, “Will ChatGPT recommend us when someone asks about auto loans in our area?”

| Aspect | Traditional SEO | GEO |

|---|---|---|

| Goal | Rank in organic results | Be cited in AI answers [14] |

| Success Metric | Clicks and rankings | Citation frequency [13] |

| Content Focus | Keywords and topics | Passage clarity and fact-density [13] |

| Platform | Google/Bing | ChatGPT, Gemini, Perplexity [14] |

To succeed with GEO, combine it with traditional SEO. Use your current SEO strategies to remain discoverable and technically sound, while enhancing your content with GEO tactics. Focus on fact-dense content that includes proprietary data, expert quotes, and statistics – elements that AI models can easily extract and cite [13]. Update your most valuable content every 90 days with new data and timestamps, as AI tools often prioritize fresh information [13][14].

Some financial institutions have already seen results, with their structured content and third-party mentions earning them visibility in high-value AI-generated prompts within just 48 hours [11].

Tracking your progress is critical. Tools like Ahrefs Brand Radar can monitor citations in ChatGPT and Gemini, while platforms like Waikay help track how accurately your brand is described in AI responses [14]. It’s not just about being cited – it’s about ensuring that AI-generated summaries correctly represent your services, rates, and benefits.

“GEO isn’t replacing SEO, but instead can be thought of as expanding upon or supplementing it.” – Andrew Hagemann, Vice President of Strategy, Terakeet [11]

This space is constantly shifting. For example, a July 2024 study found that Google AI Overviews dropped from appearing in 12% of search results to just 7% in under a month. Additionally, nearly 70% of citation positions changed within 60 days [14]. This highlights the need to treat GEO as an ongoing effort, not a one-time fix. Continuous monitoring and adjustments will be essential to staying visible in this new search landscape.

How to Measure SEO Results for Credit Unions

Measuring the right metrics is the key to understanding whether your SEO efforts are delivering results. Without clear data, you’re left guessing – and that can lead to wasted time and money. Let’s break down what you should track and when you can expect to see progress.

Which Metrics to Track

Start by focusing on organic traffic metrics. Tools like Google Analytics can help you monitor organic sessions, unique users, and pageviews. These numbers give you a sense of how well your SEO is driving visitors to your site. But traffic alone doesn’t paint the full picture – you also need to know what those visitors are doing once they arrive.

Conversion metrics reveal SEO’s real impact. To calculate your conversion rate, divide the number of desired actions – like membership applications, loan inquiries, account signups, or email subscriptions – by the total unique visits. For a deeper dive, measure your Cost-Per-Application (CPA) by dividing the total campaign cost by completed applications. For context, personal loans average around $60 per application, while mortgages can cost closer to $350 [16].

If you’re targeting local audiences, local SEO performance is critical. Use Google Business Profile insights to track how often people call your credit union directly from search results, request directions, or find you through local searches. Considering that 78% of local searches lead to offline actions within 24 hours [2], these metrics offer a direct link to member engagement.

Keep an eye on keyword rankings, especially for high-intent, long-tail keywords like “best auto loan rates in [your city].” These terms often convert better than broader, high-volume keywords with less specific intent [1][15].

For a deeper look at user behavior, analyze engagement metrics such as bounce rates, average session duration, pages per visit, and scroll depth. For instance, a high bounce rate or very short session time may indicate that your content isn’t matching searcher expectations. You can also assign a “Page Value” in Google Analytics to measure how your educational content contributes to membership applications.

Lastly, don’t overlook technical health metrics. Factors like Domain Authority, backlink quality, mobile load speed, and crawlability play a critical role in SEO success. Use Google Search Console to catch indexing errors early and request indexing for new content. Remember, 53% of mobile users will abandon a site if it takes more than three seconds to load [2].

By tracking these metrics, you’ll have a clearer picture of your SEO progress and can make informed decisions about where to focus your marketing for credit unions.

When to Expect SEO Results

SEO is a long-term game, and understanding the timeline can help set realistic expectations. Tracking the right metrics consistently will show you how your efforts are paying off over time.

Initial results can appear within days or weeks of optimizing your content, with early keyword ranking shifts [1]. However, these changes may not immediately translate into noticeable traffic increases.

Tangible traffic growth often becomes visible within 3 to 6 months as your rankings improve [1]. Breaking into the top three positions for competitive keywords usually takes 6 to 12 months of steady work [4]. For example, one credit union focused on natural keyword integration and building quality backlinks for the term “credit union website design.” Within 6 to 12 months, they reached the top three search results [4].

Local SEO tends to deliver faster results than traditional organic rankings. Improvements in Google Maps visibility and local engagement metrics can often be seen within 60 to 90 days [1]. However, conversion-focused outcomes – like more membership applications or loan inquiries – typically take 6 to 12+ months as traffic grows and your member journey is refined [1].

For a formal ROI calculation, it’s best to wait at least six months. SEO returns tend to grow over time as your online presence strengthens. To calculate ROI, subtract your total investment from your gains, divide by the cost, and multiply by 100. Be sure to include costs like SEO tools, content creation, and digital ad spend, but you can exclude fixed expenses like full-time staff salaries [16][17].

To stay on track, review your progress monthly and focus on quarterly trends. Organic search remains a powerhouse for driving results – 49% of marketers credit it as the top-performing channel, and about 40% of business revenue comes from organic search [17].

Conclusion

SEO for financial services is a powerful tool for credit unions, offering a cost-effective way to stand out in today’s competitive digital landscape. While big banks and fintech companies pour money into advertising, credit unions can focus on what they do best – serving their local communities with tailored financial solutions. By honing in on local search optimization, producing helpful educational content, and earning trust through online reviews, credit unions can connect with potential members right when they need financial guidance.

A strong SEO strategy doesn’t just boost online visibility – it drives real-world results. Think branch visits, phone inquiries, and new membership applications. Unlike paid ads, which stop working the moment the budget dries up, SEO continues to deliver value over time. This sustained visibility fosters trust, a key ingredient in an industry where credibility is everything.

To get started, focus on the essentials: fine-tune your Google Business Profile, target specific long-tail keywords, and make sure your website is fast and mobile-friendly. Then, build on that foundation by creating content that speaks directly to your members’ needs and highlights your expertise. SEO isn’t a quick fix – it’s a long-term investment that keeps paying off, helping your credit union grow and attract more members while building a reputation for reliability and trustworthiness.

FAQs

What are the best local SEO strategies for credit unions?

Credit unions can enhance their local SEO by optimizing their Google My Business (GMB) profiles. Each branch should have a claimed and fully completed GMB listing with precise name, address, and phone number (NAP) details. Keeping these profiles updated with photos, relevant details, and responses to member reviews not only improves visibility in local search results but also builds credibility with potential members.

Another effective approach is incorporating local keywords into your website content, meta descriptions, and titles. Featuring community involvement, local events, or partnerships in your content not only strengthens your connection to the area but also boosts your relevance in local searches. On top of that, earning backlinks from trusted local organizations and directories can further enhance your search rankings, making it easier for nearby audiences to discover your credit union.

These strategies can help credit unions stand out in their local markets, attract more members, and foster deeper connections within their communities.

How can long-tail keywords benefit credit unions?

Long-tail keywords offer a powerful way for credit unions to draw in highly targeted local traffic. These detailed phrases match the exact terms potential members are searching for – whether they’re looking for specific financial products or services.

By zeroing in on long-tail keywords, credit unions can boost their search engine rankings, connect with niche audiences, and carve out a distinct presence in a crowded market. This strategy not only enhances online visibility but also fosters trust and stronger engagement with potential members.

How is AI changing SEO strategies for credit unions?

AI is reshaping how credit unions approach SEO, putting a spotlight on trustworthy, member-centered content that resonates with how tools like Google’s AI Overviews and ChatGPT display information. Instead of sticking to old-school methods like stuffing keywords or chasing backlinks, the focus now shifts to creating content that showcases authority, expertise, and relevance – qualities that AI systems prioritize when delivering search results.

To remain competitive in this AI-driven search world, credit unions should concentrate on optimizing for local searches, ensuring their websites are fast, mobile-friendly, and technically reliable, and crafting content that directly addresses their members’ needs in a clear and engaging way. Building trust is equally important – think positive reviews and consistently accurate, reliable information, as AI tools often rely on these signals when summarizing results. By embracing these shifts, credit unions can continue to attract and retain members in today’s digital-first landscape.