AI chat tools can serve as a powerful AI referral partner for lenders by shaping borrower perceptions during early research. Borrowers increasingly turn to tools like ChatGPT to explore rates, loan options, and lender credibility.

Spoiler Alert: Like search engines, AI chat tools crawl the web for content. The difference is context. AI is looking for more than keywords.

So, if you’d like to be mentioned in AI chats, you must have a solid search engine optimization (SEO) program in place.

Here’s how smart SEO turns AI chat into an AI referral partner:

- AI references content that demonstrates clear subject-matter understanding. Pages that thoroughly explain mortgage options, borrower scenarios, and tradeoffs give AI the context it needs to confidently reference a lender as a credible option.

- Search-aligned content mirrors how borrowers question AI. When SEO content is built around borrower intent and real search behavior, it closely matches the way questions are asked in AI chat, making mentions more likely.

- Search visibility reinforces trust signals AI relies on. Consistent rankings, authoritative pages, and external mentions signal legitimacy, increasing the probability that AI includes a lender in its responses.

- Well-structured pages are easier for AI to interpret and summarize. Content with clear H1, H2, H3 headings, FAQs, and plain language allows AI to understand when a lender is relevant and how to reference them accurately.

Key Takeaway: To develop AI referral partners requires smart SEO. And, AI is smart, so there are no shortcuts.

Important Statistics

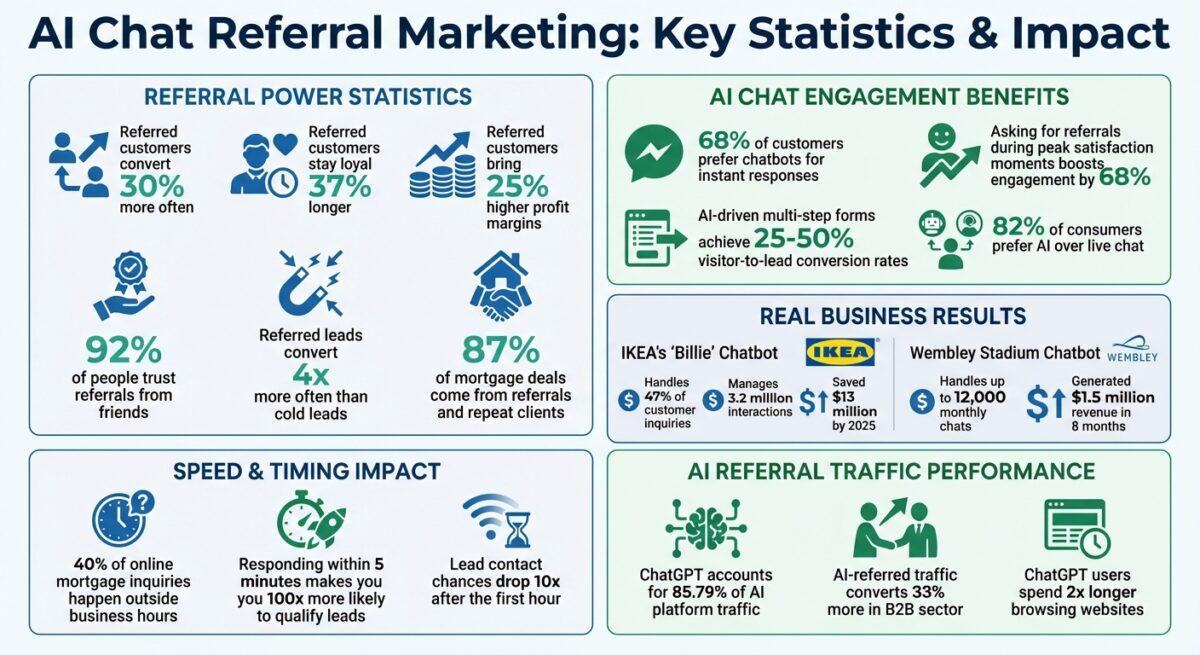

Notably, AI search traffic converts at 14.2% compared to Google’s 2.8%, demonstrating that visibility in AI responses delivers highly qualified prospects who are more likely to engage.

Why Borrowers Use AI Chat to Research Mortgages

Borrowers no longer start their mortgage journey with a phone call. Instead, they begin with questions typed into AI chat interfaces at odd hours, from their phones, before any sales conversation begins. For lenders, this shift creates an opportunity for AI chat tools to act as an AI referral partner by influencing which providers borrowers consider first.

Research confirms this shift. Nearly 35 percent of Gen Z use AI chatbots to search for information, indicating that a significant portion of younger borrowers are already relying on AI tools to find answers rather than traditional search engines alone. Furthermore, 42 percent of consumers use generative AI for recommendations and decision support, which parallels how mortgage borrowers might use AI to evaluate lenders or loan options.

What Borrowers Ask AI Chat Tools

These borrowers ask questions like “What’s the difference between FHA and conventional loans?” or “How much house can I afford making $85,000 a year?” They use AI chat to understand rate environments, compare products, and identify which lenders specialize in their situation all before scheduling a single consultation.

According to research from OpenAI, three-quarters of ChatGPT conversations focus on practical guidance and seeking information. Consequently, AI chat has become part of the early and mid-research phase. It helps borrowers build knowledge, eliminate options, and form preferences. However, it does not replace the final decision. Borrowers still need human guidance for application strategy, pricing negotiation, and closing coordination. But by the time they reach out, they’ve already formed opinions about which lenders seem credible and relevant.

AI Referral Partner Stats

As of July 2025, ChatGPT dominates AI referrals, accounting for 85.79% of traffic among major platforms. Google Gemini follows with 4.70%, while Perplexity and Claude contribute 2.84% and 2.23%, respectively [14]. Knowing which platforms drive your traffic helps you decide where to focus your efforts.

| AI Platform | July 2025 Visits | Traffic Share % |

|---|---|---|

| chatgpt.com | 5,244,855,278 | 85.79% |

| gemini.google.com | 287,535,861 | 4.70% |

| perplexity.ai | 173,581,751 | 2.84% |

| grok.com | 153,011,519 | 2.50% |

| claude.ai | 136,577,834 | 2.23% |

| copilot.microsoft.com | 97,802,733 | 1.60% |

How AI Chat Tools Find and Form Their Answers

AI chat tools do not have a database of pre-written mortgage answers. Rather, they generate responses by analyzing publicly available web content in real time, synthesizing information from multiple sources to construct coherent, contextually relevant answers.

This process relies on three core factors: context, clarity, and credibility. AI tools evaluate whether content thoroughly addresses a topic, whether it’s written in understandable language, and whether it comes from sources that demonstrate subject-matter authority.

How AI Evaluates Content Differently Than Search Engines

Unlike traditional search engines that primarily rank based on backlinks and keyword optimization, AI chat prioritizes content that provides substantive explanations and demonstrates a deep understanding of the subject.

As a result, content that merely repeats keywords without adding insight gets ignored. On the other hand, pages that explain mortgage concepts thoroughly, address borrower concerns directly, and use clear language become reference material for AI responses. This shift means lenders must focus on creating genuinely useful content rather than gaming algorithmic shortcuts.

AI Summit after hours: HousingWire leadership talks tech with industry thought leaders

The Connection Between SEO and AI Referral Partners

Strong SEO content increases the likelihood of being referenced, summarized, or mentioned in AI responses. This happens because the factors that make content rank well in search engines overlap significantly with what makes content useful to AI chat tools.

Both search engines and AI evaluate content based on relevance, authority, and user intent alignment. Search engines reward pages that earn quality backlinks, maintain consistent traffic, and satisfy user queries. Similarly, AI tools reference sources that demonstrate expertise, provide comprehensive answers, and align with the questions being asked.

Why SEO Investment Creates AI Referral Partner Opportunities

Therefore, lenders who have invested in high-quality SEO are better positioned to become AI referral partners. Their content has already been validated by search engines through rankings and traffic, which signals to AI that these sources are trustworthy and worth referencing.

The data support this connection. AI platforms generated 1.13 billion referral visits in June 2025, representing a 357% increase from June 2024. In contrast, lenders with weak SEO presence remain invisible not only in search results but also in AI chat conversations.

This connection reinforces a critical truth: SEO is not being replaced by AI it’s becoming the foundation that allows AI to function as a referral channel.

Borrower Intent Matters More Than Keywords in AI Referral Strategies

Traditional SEO often focused on high-volume keywords regardless of intent. However, AI chat forces a different approach. Borrower intent now matters more than keyword volume when creating content that AI tools will reference.

For example, a borrower asking “Should I wait for rates to drop before buying?” has a different intent than someone searching “current mortgage rates.” The first question reflects decision-stage uncertainty and needs content that addresses timing considerations, market volatility, and personal financial readiness. The second is informational and transactional, focused on immediate data.

Aligning Content to Borrower Decision Stages

Content aligned to borrower questions and decision stages is more likely to be useful to AI chat than content chasing high-volume terms. AI tools excel at understanding nuance and matching content to intent. They recognize when a page genuinely answers a question versus when it simply contains related keywords.

Google’s AI Overviews now appear in more than 50% of all search results, marking a major shift in how borrowers receive information. Consequently, lenders should map content to the actual questions borrowers ask at each stage of their journey – awareness, consideration, and decision. This approach not only improves SEO performance but also increases the probability that AI chat tools will reference that content when responding to similar questions.

Why Authority and Visibility Influence AI Referral Partner Trust

AI chat tools do not blindly reference any content they find. Instead, they rely on trust signals to determine which sources are credible enough to include in responses. These signals mirror the authority indicators that search engines use to rank content.

Consistent search visibility acts as a primary trust signal. Lenders whose pages consistently appear in top search results demonstrate ongoing relevance and authority. AI tools recognize this pattern and are more likely to reference these sources when generating responses.

Structuring Content For Your AI Referral Partner

Even excellent content can be overlooked by AI chat tools if it’s poorly structured. Clear page structure, FAQs, headings, and plain language make it easier for AI to understand and accurately reference a lender’s content.

Start with logical heading hierarchy. Use H1 for main topics, H2 for major sections, and H3 for supporting points. This structure helps AI quickly identify what each section covers and how information is organized, making it easier to extract relevant details for responses.

Using FAQs and Plain Language for AI Accessibility

Incorporate FAQ sections that directly answer common borrower questions. AI chat tools frequently pull from FAQ content because it’s already formatted as question-and-answer pairs, matching how borrowers phrase their queries. For instance, an FAQ answering “What credit score do I need for an FHA loan?” gives AI ready-made content to reference.

Use plain language throughout. Avoid jargon, complex sentence structures, and vague terminology. AI tools prioritize easily understandable content, as this ensures accurate interpretation and reduces the risk of misrepresenting information in responses.

Finally, ensure each page has a clear purpose and stays focused on a specific topic. Pages that try to cover too many subjects make it difficult for AI to determine relevance. Focused content that thoroughly addresses one topic is more likely to be referenced when that topic comes up in AI chat conversations.

What AI Chat Can and Can’t Do as an AI Referral Partner

AI chat tools are powerful research assistants, but they have limitations. Understanding what AI can and cannot do helps lenders set realistic expectations about how AI referral partners fit into their lead generation strategy.

AI chat can introduce borrowers to lenders they hadn’t previously considered by surfacing relevant content during research conversations. It can explain mortgage concepts, compare loan products, and provide general guidance on affordability and qualification. In this way, AI acts as an early-stage referral source, expanding a lender’s reach beyond traditional marketing channels.

The Limitations of AI as an AI Referral Partner

However, AI does not replace referrals or relationships. It cannot negotiate rates, customize loan structures, or navigate unique borrower situations. It lacks the personal touch, relationship-building capacity, and ethical accountability that human loan officers provide. Borrowers still need direct lender engagement for application support, pricing decisions, and closing coordination.

Moreover, AI chat does not guarantee conversion. Being mentioned in an AI response puts a lender on the consideration list, but it does not ensure the borrower will choose that lender. Other factors—reputation, local presence, pricing competitiveness, and customer service—still determine final decisions.

Research shows that 58.5% of Google searches in the U.S. end without a click, meaning borrowers increasingly rely on AI-generated summaries. Therefore, AI chat should be viewed as a top-of-funnel tool that influences which lenders are considered during research, not as a replacement for traditional referral partnerships or direct marketing efforts.

SEO as the Foundation for AI Referral Partner Visibility

SEO is the foundation that allows AI chat to act as a referral partner, not a separate channel or shortcut. Lenders cannot bypass SEO and expect AI tools to magically surface their brand. Instead, strong SEO creates the conditions that make AI referrals possible.

High-quality SEO content ensures that a lender’s expertise, product offerings, and brand presence are documented and accessible across the web. This content becomes the raw material that AI tools analyze when generating responses. Without it, AI has nothing to reference.

What This Means for Mortgage Lenders

Lenders who invest in high-quality SEO content position themselves to be discovered both in search engines and AI chat conversations. This dual visibility creates compounding advantages as borrowers increasingly use both channels during their research process.

Practically, this means lenders should audit their existing content for clarity, depth, and structure. Pages that merely list services without explanation need to be rewritten to address borrower questions and provide meaningful context. Content should be organized with clear headings, FAQ sections, and plain language that both search engines and AI tools can interpret.

Taking Action on AI Referral Partner Strategy

Lenders should also prioritize building authority through consistent content creation, industry partnerships, and backlink development. These efforts may not yield immediate results, but they create the trust signals that make AI referral partners effective over time.

Finally, lenders must recognize that AI chat is not a trend to monitor from a distance. It’s already influencing how borrowers research and evaluate lenders. The question is not whether to adapt, but how quickly lenders can position themselves to benefit from AI’s role as an emerging AI referral partner in the mortgage decision process.

FAQs

How does SEO help AI chat tools refer borrowers to me?

Strong SEO helps ensure your content is authoritative, well structured, and aligned with user intent, all of which make it more likely that AI tools will find and include your content in their generated answers to relevant queries.

What kind of content makes AI mention my company?

Content that is thorough, organized with clear headings and FAQs, written in plain language, and directly answering real user questions increases the chance that AI chat tools will use it when generating responses.

Conclusion

SEO is the foundation that allows AI chat to act as a referral partner. Lenders cannot bypass SEO and expect AI tools to surface their brand.

AI Overviews increased presence by 155% comparing Q4 2024 to Q1 2024. As AI adoption grows, the gap between lenders with strong SEO and those without will widen. Start by auditing your content for clarity, depth, and structure. Prioritize building authority through consistent content creation and industry partnerships.

AI chat is already influencing how borrowers research and evaluate lenders. The question isn’t whether to adapt, but how quickly you can position yourself to benefit from AI’s role as an AI referral partner.