Website traffic for lenders is plummeting due to the increasing popularity of AI search tools like ChatGPT, Google’s Gemini, and Perplexity. These tools provide instant, direct answers to borrower questions, which eliminates the need to visit lender websites for complete answers. Here’s a quick breakdown:

- 96% drop in referral traffic and 34.5% decline in organic click-through rates as AI tools dominate search behavior.

- 60% of searches now result in zero clicks, with users finding answers directly on AI-generated summaries.

- AI Overviews on platforms like Google reduce visibility and traffic, even for top-ranking content.

Key Changes in Borrower Behavior:

- One search delivers a complete answer – no need to visit multiple websites.

- AI tools handle comparisons, calculations, and recommendations directly.

- Trust shifts from lender websites to AI-generated summaries.

There’s Good News, Too!

AI Search Levels the Playing Field

While the article headline might sound alarming, the reality is far more hopeful: the rise of AI search levels the playing field. No longer dominated by Goliaths with deep pockets (we all know who I mean), search is becoming about relevance, quality, and usefulness, which gives smaller IMBs a chance to show up in a Google search in ways that were almost impossible before.

Today, it’s less about who spends the most and more about who delivers the best answer, making this a pivotal moment for IMBs that want to generate borrower leads online.

What’s Different? Before AI vs. After AI

| Before AI Search | After AI Search |

|---|---|

| Users visited multiple lender websites. | AI provides all answers from one search. |

| Borrowers manually compared rates. | AI offers instant, aggregated comparisons. |

| Trust built through repeated visits. | Trust shifts to AI’s authoritative answers. |

To regain traffic, lenders must adapt their SEO strategies to create AI-friendly content, use structured data, and focus on building the authority that AI tools recognize.

How AI Search Reduces Website Traffic

From Keywords to Curated Answers

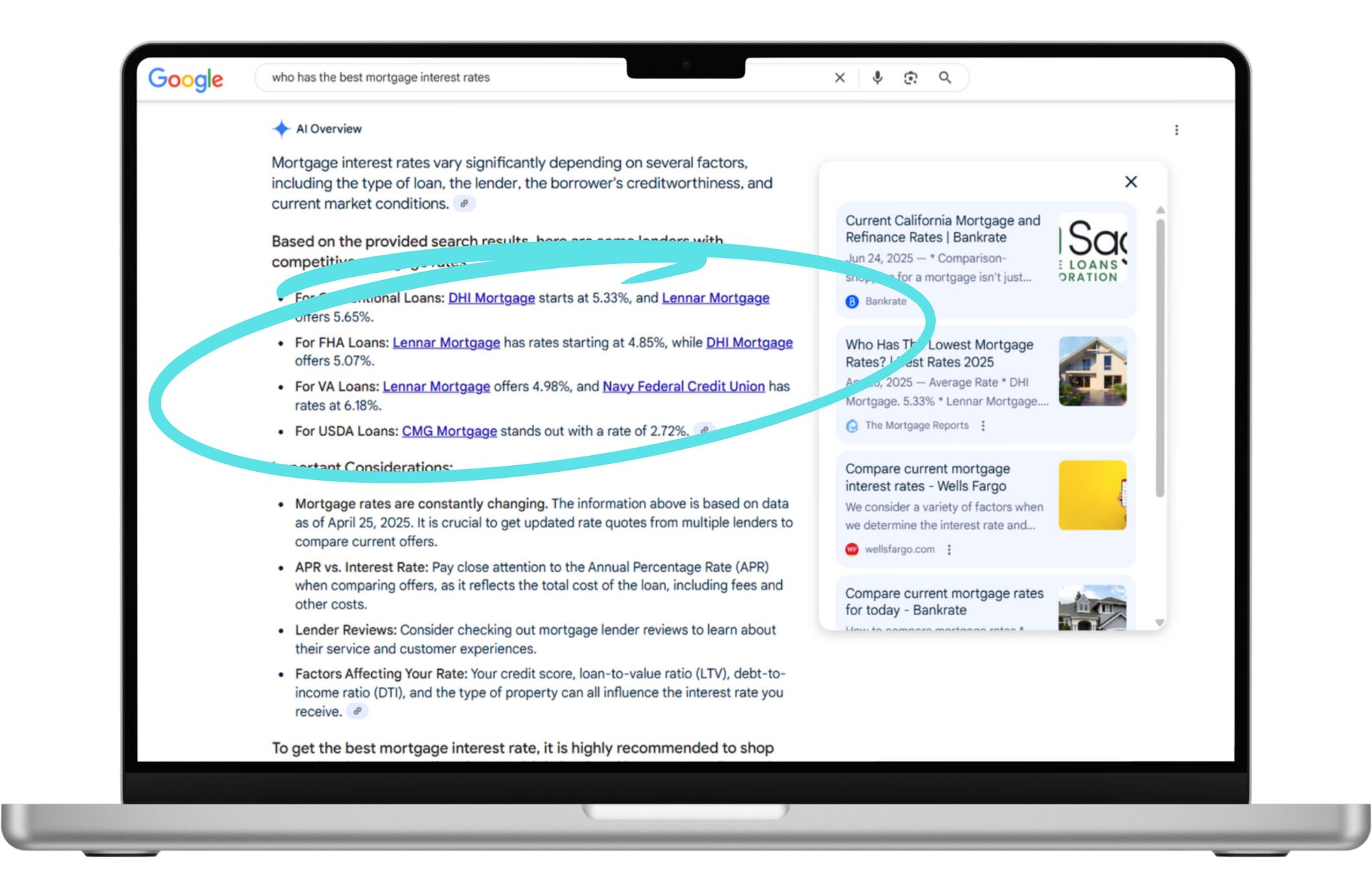

The way search results are displayed is completely different. For instance, if someone searches for “mortgage rates for first-time buyers”, they no longer see a list of blue links leading to several lender websites. Instead, they get a concise, AI-generated summary that consolidates key information at the top of the page.

This shift pushes traditional website links much further down the results below the dreaded “fold.” What was once the prized “number 1 position” in a Google search is now overshadowed by AI-generated content that dominates the screen. For lenders who have spent years fine-tuning their websites to rank at the top, this change is a major blow to their visibility.

These aren’t the lenders we typically see at the top of the search results.

Click-through rates (CTR) for top-ranked informational keywords reflect this impact, dropping from 5.6% in March 2024 to just 3.1% by March 2025 [4]. AI summaries usually draw from only a small pool of high-ranking websites [1], leaving many lenders almost invisible in search results. This trend is driving a surge in what are known as zero-click searches.

Zero-Click Searches Are Now Normal (Ugh. Read That Again)

The rise of “zero-click searches” demonstrates how people now interact with online information, and how Marketers track success metrics.

Instead of clicking through to websites, users now get their answers directly on the search results page. What was once an occasional behavior has now become the norm.

In the United States, 60% of searches in 2024 resulted in zero clicks, a sharp increase from 26% just two years earlier [3]. For lenders, this means most potential borrowers never make it to their websites.

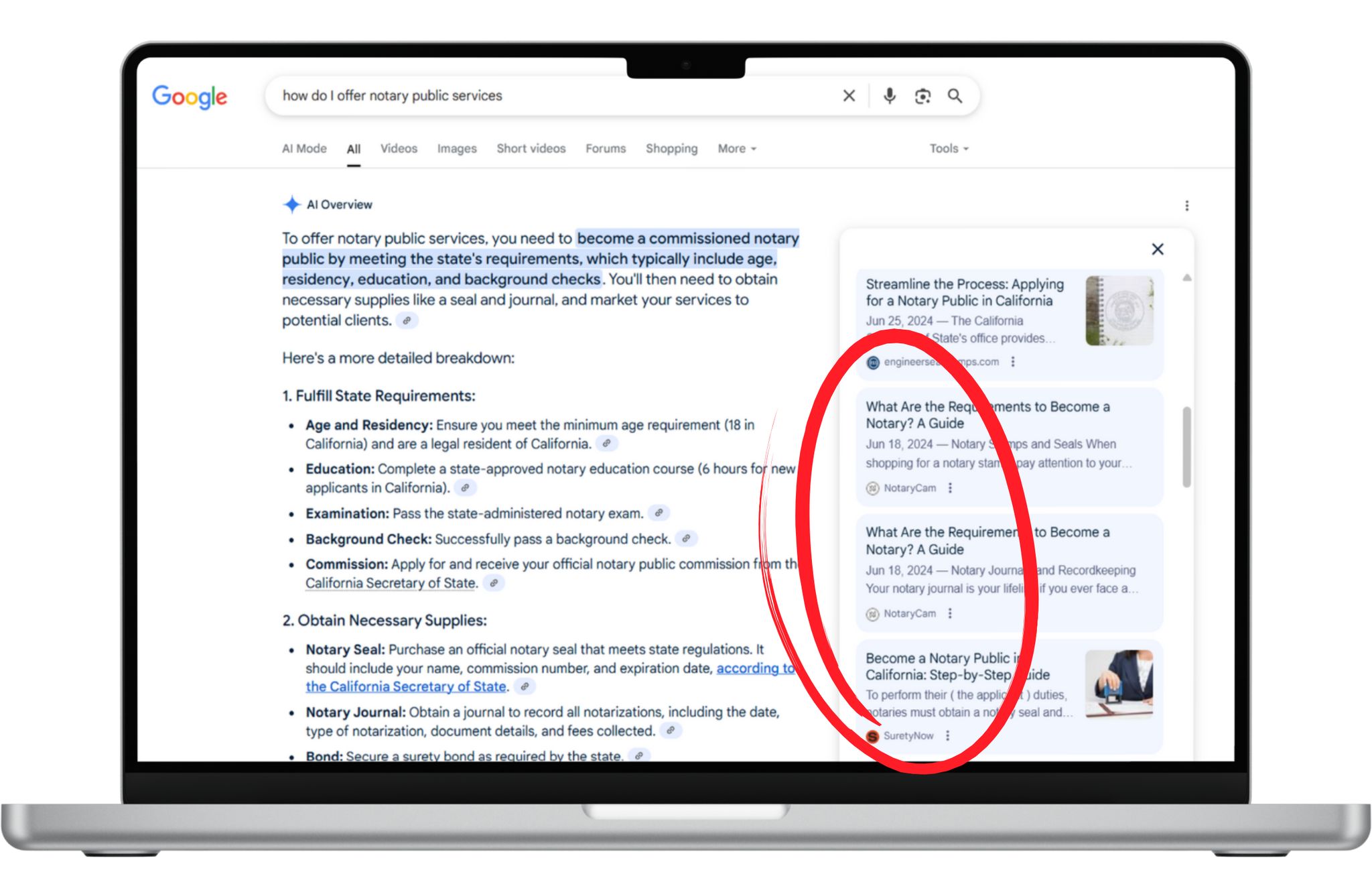

Industry vendor prioritizes content, shows up twice.

Go All In on Content. AI Will Reward You

In AI search, one piece of content is no longer enough. AI search tools understand context. Smart industry brands are responding by going all in, creating varied, authoritative content that captures every angle of a topic.

The payoff? AI search engines can show a site multiple times if it finds:

- Multiple pages addressing questions related to the query

- A mix of educational articles and service pages

- High‑trust, authoritative sources it can lean on

- Strong links between answers and their sources

- Rich, layered content that works across fresh and evergreen searches

In this new landscape, depth and variety aren’t optional – they’re how AI decides which brands dominate the results.

“Content is becoming the new performance marketing. As paid channels get more expensive and traditional search fragments, your best lever for growth is content. Not just any content, but content that AI sees as helpful, credible and worth including”, says Erik Wikander, Co-founder and CEO of Wilgot.ai [1].

Why Lender Websites Get Hit the Hardest

Borrowers Search Differently Now

AI tools provide fast, comprehensive answers, and often include information that the AI anticipates the potential borrower might need.

For example, when searching for “mortgage loans for low credit scores,” borrowers get a comprehensive response that could include related information, such as how mortgage insurance works and down payment assistance programs. Unfortunately for lenders, this eliminates the need for additional searches and reduces the odds of a website visit.

Before AI vs. After AI: What Changed

Here’s a side-by-side look at how borrower behavior has evolved:

| Before AI Search | After AI Search |

|---|---|

| Borrowers visited multiple lender websites for research | AI provides comprehensive answers in a single query |

| Users viewed several pages per session to gather fragmented information | One interaction delivers a complete information package |

| Lenders captured leads through content downloads and interactive tools | AI tools offer calculations and insights directly, no leads captured |

| Trust was built through repeated visits and brand exposure | Trust shifts to AI’s authoritative summaries |

| Comparison shopping required visiting competitor websites manually | AI tools offer instant, aggregated comparisons |

This shift has hit informational content hard. Mortgage guides, checklists, and educational resources – once major traffic drivers – are now condensed into AI-generated summaries.

Bottom line: Lenders need to rethink their digital strategy and create content that AI tools recognize as authoritative, and find innovative ways to turn that into borrower relationships.

I lost 30% search traffic to AI… What do I do?

How to Fix Your SEO for AI Search

Once you understand how AI influences your traffic, it’s time to adjust your SEO strategy. AI-powered search is changing the game, and adapting your website to meet these new standards can help you regain lost traffic. Here’s a few practical strategies that align with these AI-driven changes.

sbb-itb-16c0a3c

Make Your Website AI-Friendly

To address the decline in organic clicks, focus on technical improvements that cater specifically to AI crawlers. Unlike traditional search bots, AI systems prioritize websites that are fast, mobile-friendly, and structured for easy readability. Start by improving your Core Web Vitals, which measure page speed and overall user experience.

For example, reduce the load time of your Largest Contentful Paint (LCP) – the largest visual image on a page – and you cut your server response time. This can lead to a double-digit boost in organic traffic from AI search results.

Using structured data is another crucial step. It acts as a roadmap, helping AI systems understand your content better. For lenders, the most effective schema types include:

- LocalBusiness schema: Perfect for branch locations and contact details.

- Service schema: Highlights specific loan products.

- FAQPage schema: Addresses common borrower questions.

- Article schema: Ideal for educational content.

Implement schemas and validate them with Google’s Rich Results Test. Also, ensure your robots.txt file doesn’t block AI crawlers, which could limit your visibility in AI search tools.

Create Content That AI Search Tools Will Use

Provide clear, conversational answers to users’ questions. Think of it as mimicking the way a helpful loan officer explains things to a borrower.

“AI is reshaping how B2B buyers discover brands, turning to tools like ChatGPT and AI Overviews for direct, curated answers. This shift raises the bar for visibility, favoring content that is structured, clearly formatted, and credible.” – Kelsey Voss, eMarketer [9]

Start by addressing the most common questions with a concise, direct response. Use conversational headings that mirror how people naturally phrase their questions, like “How Much Can I Afford to Borrow?”

Break your content into scannable sections with short paragraphs, bullet points, and clear subheadings.

Regularly update your content, especially in fields like lending, where regulations and rates change frequently. AI systems favor fresh, up-to-date information. This is true of your website pages and your blog articles.

Organize Your Website for AI

The structure of your website also plays a big role in how AI interprets it. Guide AI systems by creating topic clusters around key lending themes, such as first-time homebuyer tips, refinancing guides, or HELOC lending resources. This approach strengthens your authority on these subjects.

Use semantic URLs that indicate page content – for example, “/first-time-buyer-fha-loan-guide” is much more effective than a generic “/page-47.” On longer pages, include a clickable table of contents to make navigation easier for both users and AI systems.

Consider adding Speakable schema to key pages. This can improve your visibility in voice search and AI-powered audio responses, as it highlights content that’s ideal for spoken answers.

Your Next Steps with RankWriters

Now that you’ve explored these SEO strategies, it’s time to put them into action. Adapting to AI search trends is essential to staying ahead.

Key Focus Areas for AI Search

Create clear, borrower-focused content that AI can easily process.

AI tools are designed to prioritize content that directly answers users’ questions. For example, if someone searches, “Can I get a mortgage with a 620 credit score?”, they’re looking for a simple, direct response – not a long-winded, jargon-filled sales pitch.

Structure your content for AI indexing.

Organize your content using a question-and-answer format and conversational language. AI systems favor content that’s easy to summarize and identify as trustworthy sources [10].

Establish authority across multiple platforms.

Offer well-researched industry insights to position yourself as a credible source. This increases the chances of AI models referencing your content in their responses [11].

Focus on semantic relevance, not just keywords.

Instead of zeroing in on exact keyword matches, aim to cover topics thoroughly, providing depth and context.

These strategies are at the core of what RankWriters delivers.

How RankWriters Can Help

RankWriters specializes in crafting content designed to perform well on both traditional and AI-powered search platforms.

Here’s how they address different stages of the borrower journey:

- Top-of-funnel content: General educational topics like “What is DTI?” that attract a wide audience.

- Mid-funnel content: Targeted searches such as “Conventional vs. FHA loan in Pennsylvania.”

- Bottom-of-funnel content: Hyper-local SEO pages like “Refinance a Jumbo Loan in Marin County”.

Beyond content creation, RankWriters uses digital PR strategies to secure mentions in high-authority publications. This builds credibility and topical authority through expert commentary and thought leadership [11].

What Lenders Should Do Now

First, reevaluate your content strategy. Start by auditing your current content. Replace sales-heavy pages with concise, educational pieces, and develop a content calendar that addresses all stages of the borrower journey.

Here’s what to focus on:

- Use clear headings and short, readable paragraphs.

- Write in a natural, conversational tone that’s easy to understand when read aloud.

- Build authority by creating research-backed articles tailored to borrowers’ needs.

Lenders who adapt their strategies now will stay competitive as AI search continues to evolve. Waiting could mean falling behind and losing valuable traffic.

FAQs

How can lenders generate website leads in AI search?

To thrive in a search landscape increasingly shaped by AI, lenders need to prioritize developing clear, informative, and authoritative content that directly addresses the most pressing questions borrowers have. This could mean creating in-depth FAQs, comprehensive guides, and resources that tackle common concerns borrowers face. Leveraging structured data is another smart move – it helps AI systems better interpret and showcase your content in search results.

Equally important is tailoring your website to align with AI-driven search preferences. This involves organizing your site around key topics, incorporating content rich in relevant entities, and ensuring all information presented is accurate and reliable. By focusing on delivering content that is genuinely helpful and user-centered, lenders can boost their visibility and stay relevant in an ever-evolving AI-powered search environment.

Why does AI search impact lender websites more than other industries?

Lender websites face distinct hurdles when it comes to AI-driven search, largely due to the highly regulated and sensitive nature of the financial sector. Mortgage and lending platforms must comply with strict regulations, navigate lengthy decision-making processes, and build trust with potential borrowers. These elements make it challenging to adapt swiftly to AI-generated answers, which tend to favor concise, authoritative content.

At the same time, borrowers increasingly turn to AI tools for quick, straightforward answers instead of browsing traditional websites. This shift pushes lenders to prioritize creating reliable, well-crafted content that not only aligns with AI algorithms but also addresses customer concerns in a clear and approachable manner.

How can lenders update their content to do well?

To make sure their content is seen as reliable by AI tools, lenders should prioritize creating well-organized, authoritative content. Use straightforward, clear language and include detailed FAQs that answer common borrower concerns. Adding structured data markup can also help AI systems interpret your content more effectively.

Keep your content up-to-date by conducting regular reviews and revisions to ensure accuracy and relevance. Transparency is essential – clearly outline product details, services, and regulatory compliance. By focusing on high-quality, helpful content that meets borrower needs, lenders can boost their visibility in AI-driven search results.