Insurance Agencies: 69% of insurance shoppers research online first.

You have to be there to be considered. We offer a proven SEO solution to generate leads and we have the proof that it works.

Google searches just happened.

Did you show up in any of them?

Our content pillar strategy puts you in front of people searching for insurance.

It's a painstaking but tremendously effective strategy. It helps us write content that answers the questions people type in the Google search bar.

In short, it puts you at the right place at the right time. See how well it's working.

Content pillars are pivotal to SEO success.

Tell us about your business, goals, and competitors. We will use this information to research and develop a competitive keyword and content strategy roadmap.

The strategy roadmap will be a 6-month plan. At month six, we check in to see what may have changed to make any adjustments.

Here's a sample one-month content plan based on a law firm client.

Ready to grow your business? Let's talk.

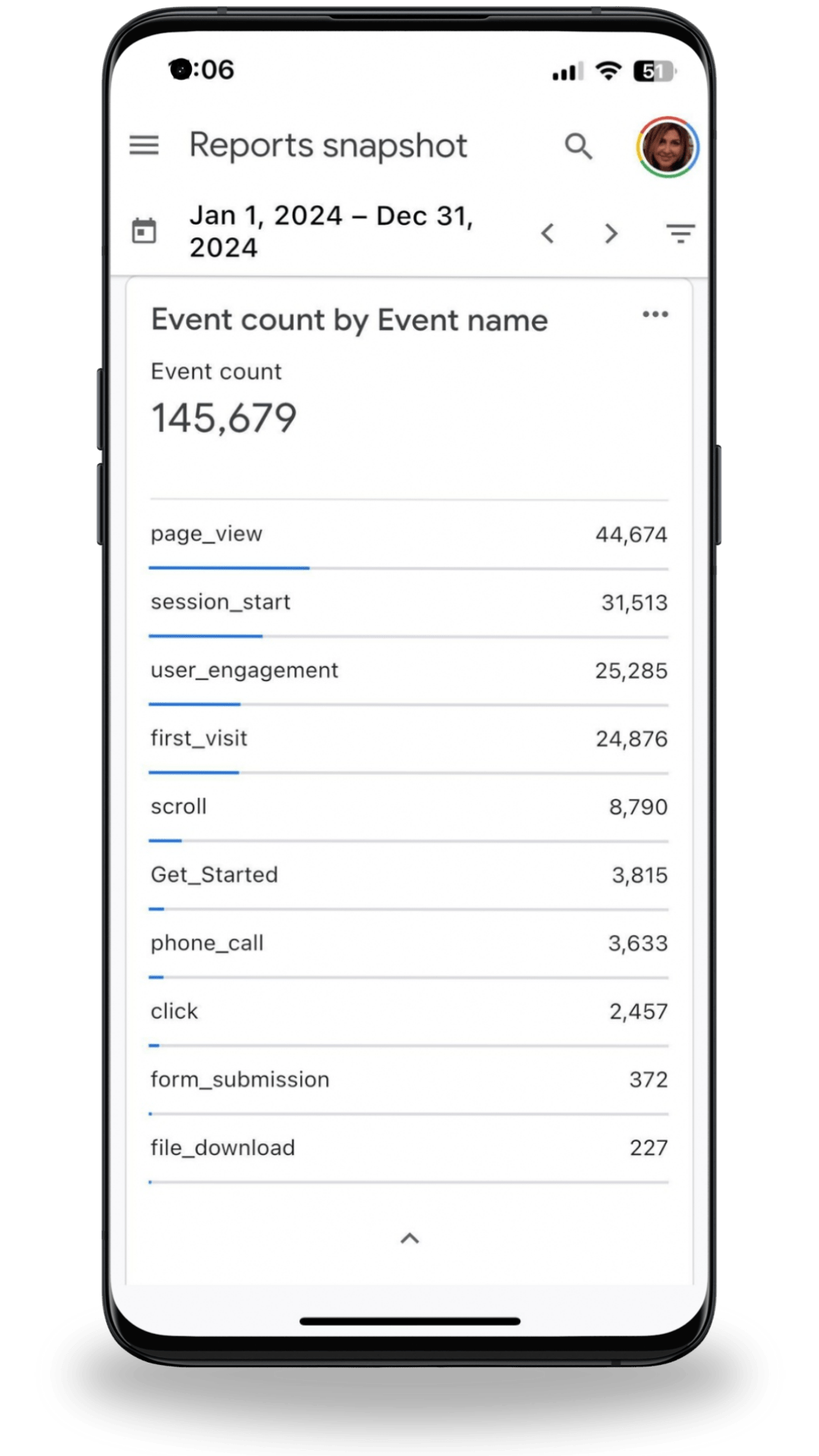

SEO boosted page 1 keyword growth 297% in 9 Months

For this service provider, more visibility means more clients gained.

They turned to us when their organic traffic had dwindled and their old SEO tactics wouldn't work.

We designed a powerful SEO content strategy, featuring 16 informative monthly blog posts designed to attract, educate, and convert potential clients.

They were thrilled with the increased visibility and traffic that seemed to skyrocket with every search algorithm update:

- Page 1 Keywords: from 304 to 1,903 (+525.99%)

- Page 2 Keywords: from 32 to 1,280 (+3,900%)

- SERP Features: from 51 to 1,670 (+3,174.51%)

Don't skip Google: It's the first stop for insurance shoppers.

To drive more leads and sales, your insurance agency must be easily discoverable in search engine results.

That's why we focus on the power of intent. People search online with a specific goal in mind, whether it's to compare rates, learn about coverage options, or get a quote.

Our content strategy puts your agency at the forefront of these intent-driven searches, increasing your visibility and attracting more leads.

Want to learn more about harnessing the power of search? Download our eBook "Content Marketing & SEO for Insurance Agencies" to get started.

For about $46 a day, we craft and publish a full month's worth of insurance agency content and deliver it on a silver platter.

SEO is more than simply words on screen. It's content developed based on user intent. With your potential clients conducting research to select an insurance agency, their intent is to:

- Gather Information

- Investigate Options

- Initiate a Transaction

Sites that post 3+ times per week get 300% more traffic (HubSpot)

Don't let comfort become stagnation!

Getting found online isn't enough. Smart SEO positions you for intent-driven searches, where potential clients are actively seeking your insurance expertise.

We keep you ahead of the curve, navigating algorithm shifts and competitor tactics to ensure you rank for the keywords that convert.

Don't let your competition steal the spotlight. Secure your spot at the top of searches that matter.

9900+ Google searches just happened.

Where did you rank in them?

Factors that boost your SEO success.