If you could walk into the sphere of insurance thought leadership today, you’d find that innovation reigns supreme—it’s not just jargon but an active mission. Thought leaders confront challenges like climate change head-on while also harnessing AI to redefine what customers expect from their insurers.

Last year alone, cyber attacks surged by 300%, propelling cyber insurance from a niche market to front-page news. The stakes? Higher than ever. Meanwhile, healthcare costs continue their upward spiral, challenging insurers to predict and manage expenses effectively without compromising on care quality.

The journey doesn’t end here. With every new tech advancement or change in what people want, fresh challenges and chances pop up—pushing leaders in the insurance industry to think like both sharp business minds and forward-thinking trailblazers.

What is Insurance Thought Leadership?

Insurance thought leadership quietly drives the industry’s future. It’s about more than just ideas; it’s sharing insights that push boundaries and spark real change.

As someone who’s been in the trenches of insurance for over a decade, I’ve seen firsthand how thought leadership can transform the way we do business. It’s not just a buzzword – it’s a mindset that separates the innovators from the imitators.

Definition of Insurance Thought Leadership

If you’re curious about what makes up insurance thought leadership, it’s really just presenting cutting-edge thoughts and expert opinions aimed at advancing the industry. Imagine leading a conversation that’s shaping future trends in your field.

Positioning yourself or your company as a leader in the insurance sector involves sharing knowledgeable perspectives on critical matters. By doing so, you become a dependable source of information that others turn to first.

Importance of Insurance Thought Leadership

Why does insurance thought leadership matter? Because the industry is facing some pretty big challenges these days – from climate change to cyber threats to rising healthcare costs.

With smart ideas and effective strategies, thought leaders guide insurance firms in staying current with industry shifts while enhancing client services. For deeper insight into these contributions, visit the site here: Insurance Thought Leadership

Thought leadership also helps build trust and credibility with stakeholders, positioning organizations as innovators and experts in their field.

Key Characteristics of Insurance Thought Leaders

So, what does it take to be an insurance thought leader? In my experience, the most successful thought leaders share a few key traits:

- Deep industry expertise

- Forward-thinking mindset

- Ability to communicate complex ideas clearly

- Willingness to challenge conventional wisdom

- Commitment to continuous learning and collaboration

Insurance thought leadership means more than brainstorming brilliant concepts; it’s about standing firm behind your thoughts and inspiring genuine change within the sector.

Top Insurance Thought Leadership Topics

Being an insurance thought leader, I’m always in tune with what’s hot and happening in the industry. These days, there are plenty of hurdles to overcome but also many chances to innovate.

The insurance industry is grappling with big questions about climate change, cyber risks, and shifting customer expectations. Thought leaders like us at Insurance Thought Leadership are here to find solutions.

Climate Change and Risk Management

Climate change is one of the most pressing issues today. With extreme weather events becoming more common and intense, insurers are struggling to figure out how to properly evaluate and price risk in this new environment.

Insurance thought leaders are developing creative solutions such as parametric insurance and collaborating with climate resilience specialists. Their goal is to manage these risks better and safeguard neighborhoods.

Healthcare Costs and Insurance

In discussions about insurance thought leadership, one hot topic is how much healthcare costs are going up. With premiums soaring and people paying more out of pocket, there’s pressure on insurers to reduce these expenses without sacrificing care quality.

Innovative concepts being tested include switching to value-based care systems, harnessing data analytics for predicting healthcare expenses, and launching wellness initiatives focused on prevention.

Customer Experience in Insurance

You can’t discuss [insurance thought leadership topics](https://www.insurancethoughtleadership.com/) without focusing on customer experience. With everything going digital, people want quick and personal service from their insurance providers – it’s up to us to make that happen.

From mobile apps to smart chatbots and advanced AI underwriting, insurance thought leaders are embracing new technologies to improve how customers interact with their services and build long-term loyalty.

Cyber Insurance and Data Protection

It’s not enough to just follow cyber attack protocols anymore. We need to ask, “Are these measures effective?” James Gerber explores this idea in his article ‘Changing Face of Cyber Insurance.’ Check it out here: www.insurancethoughtlea… #insurance #cyber pic.twitter.com/QyNVBaI…

The tweet points out that cyber insurance is now crucial for insurance thought leaders. As cyber threats grow, insurers struggle with how to measure and price this risk properly. They’re focused on creating strong solutions for managing risks while aiding clients in their recovery from such events.

Insurance Fraud Prevention

Every good insurance thought leadership blog needs to tackle the ongoing fight against insurance fraud. Experts are using advanced data analytics and blockchain technology to uncover schemes like medical overbilling and complex car insurance scams.

The ultimate aim of insurance thought leadership is to move our industry ahead by discovering innovative ways to tackle its biggest issues and ensuring a more robust future. This goal excites me, and I’m thrilled to contribute.

How Insurance Thought Leaders are Shaping the Industry

Being an insurance thought leader, I’ve witnessed firsthand how creative minds are revolutionizing the industry. From spearheading digital initiatives to shaping regulatory changes, these leaders are making a huge impact on insurance every day.

I love being in this community because we get to watch how our thoughts and suggestions directly influence the insurance landscape. We don’t just discuss improvements – we make them a reality.

Driving Innovation and Digital Transformation

Pioneering change in insurance is what we do best at Insurance Thought Leadership. We’re integrating cutting-edge tech such as AI, blockchain, and IoT to innovate products and improve efficiency for a better customer experience.

But it’s not just about the tech itself – it’s about fostering a culture of innovation and experimentation within insurance companies. Thought leaders are the ones encouraging their teams to think outside the box, take risks, and embrace change.

Influencing Regulatory and Policy Changes

Insurance thought leaders play a big part in shaping industry regulations. They give expert advice to policymakers on necessary changes that promote new ideas, protect customers, and ensure the stability of the insurance market.

Pushing for change means more than advancing our interests alone. We’re committed to teaching those in power—and regular citizens too—about complicated industry matters so that finding a middle ground becomes easier and beneficial advancements are made possible.

Addressing the Protection Gap

The global insurance industry is grappling with a major issue known as the protection gap. This gap represents the shortfall between necessary coverage and what people or businesses actually have. Insurance thought leaders are busy crafting new risk transfer methods to bridge this divide, aiming to make insurance more accessible in areas that need it most.

From creating microinsurance plans for low-income families to offering parametric insurance that covers natural disasters, thought leaders are coming up with innovative ways to expand the reach and benefits of the insurance sector.

Fostering Collaboration and Partnerships

Those at the forefront of insurance know that addressing industry challenges means coming together. We are creating connections between insurance companies, technology experts, academic minds, and various stakeholders to exchange knowledge and develop new approaches.

It’s more than just formal partnerships. We need to build a culture where openness, transparency, and sharing knowledge thrive in the insurance space. At the end of the day, we’re all on this journey together. Only by collaborating can we truly improve the insurance business.

Strategies for Effective Insurance Thought Leadership

Building a reputation as an authority in the insurance field demands both hard work and strategic thinking. Focus on developing fresh ideas that add real value, helping you rise above competitors.

Having spent more than a decade in insurance, I know how crucial it is to engage in leadership content marketing. Providing valuable insights and demonstrating expertise truly matters. Learn why it’s important by visiting this link here.

Developing Unique and Valuable Insights

An influential insurance thought leader provides original takes on industry matters. Achieving this requires not just extensive knowledge but also keen analytical abilities to navigate intricate situations successfully.

When I first jumped into this field, I spent endless hours pouring over industry reports and crunching numbers. It was pretty boring at times, but in the end, it paid off because I spotted trends and insights that everyone else missed.

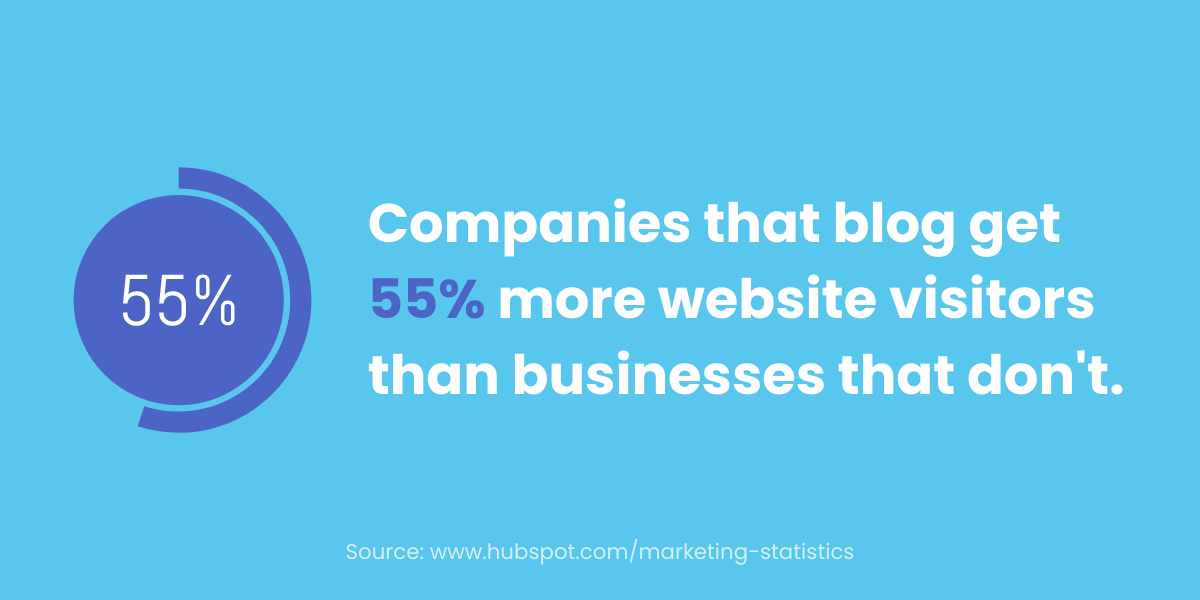

Leveraging Multiple Channels for Distribution

Once you have your insights ready, it’s time to share them widely. Use blog posts, whitepapers, speaking gigs, and webinars to make sure you’re reaching your audience wherever they are.

For insurance thought leaders, social media offers an incredible opportunity to interact with followers in real-time and foster a loyal group of engaged listeners.

Engaging with Key Stakeholders and Influencers

To really make waves as an insurance thought leader, start by connecting with key players in the industry. Build strong relationships with influential leaders and policymakers who can help amplify your ideas.

Going to industry events and conferences can really help you make valuable connections. But instead of just passing out business cards, spend time listening and learning from others. You never know; your next big idea might come from a surprising conversation.

It’s not just about asking if companies have protocols to fend off cyber attacks anymore. We need to ask, “Are these measures effective?” James Gerber dives into this topic in his article ‘Changing Face of Cyber Insurance.’ Check it out at www.insurancethoughtlea… #insurance #cyber

As James Gerber highlights in the tweet above, effective insurance thought leadership involves asking tough questions and challenging the status quo, not just following established protocols when it comes to cyber insurance.

Measuring the Impact of Thought Leadership Efforts

Measuring the success of your thought leader activities involves more than just tracking website hits and social media interactions. Take a step back and consider the broader effects as well.

As an insurance thought leader, ask yourself if you’re driving change. Are your ideas influencing policies and guiding clients through difficult challenges?

The Future of Insurance Thought Leadership

The insurance industry is changing fast, and thought leaders need to keep up. With new technologies popping up and risks constantly shifting, there’s always something fresh to tackle.

Change brings opportunities too. If you’re an insurance thought leader, you can help steer the industry’s future while making positive impacts on society.

Embracing Emerging Technologies

Insurance experts stand on the brink of transformation with today’s cutting-edge tech. By harnessing artificial intelligence, exploring machine learning capabilities or adopting blockchain solutions along with IoT advances—they’ll see remarkable changes unfold across their sector soon enough.

It’s not just about adopting new technologies for the sake of it. It’s about understanding how these technologies can create value for customers and drive business growth. As an insurance thought leader, you need to be at the forefront of these conversations.

Addressing Evolving Risks and Challenges

Facing the many changes in today’s world is a top priority for insurance thought leaders. From handling the impacts of climate change to protecting against cyber attacks and adapting to shifting demographics and customer expectations, there’s plenty on their plate.

These challenges can actually open doors for innovation and growth. By creating fresh risk management solutions and inventive risk financing solutions, insurance thought leaders can guide their clients through these tough times, helping them come out even stronger.

Empowering Insurance Professionals

Being an insurance thought leader comes with the duty of uplifting those in the field. You should focus on providing educational opportunities, promoting innovative thinking alongside collaboration, and recruiting diverse talent to enrich the sector.

Mentoring the next generation of insurance leaders is important. By passing on your wisdom and experiences, you help shape a strong future for the industry.

Driving Positive Change in Society

At last, insurance thought leaders get the chance to bring about positive societal changes. Whether it’s pushing for wider access to financial services or addressing the protection gap, their efforts also support our move toward a greener future.

Creating a better future takes bold ideas and nonstop work. If you’re an insurance thought leader, your influence can truly make waves. Use that power thoughtfully.

The future of insurance thought leadership looks bright, but it does come with its hurdles. By jumping on new tech trends, tackling shifting risks head-on, giving insurance professionals the tools they need, and pushing for societal progress, we can pave the way to a better industry.

Conclusion

Insurance thought leadership isn’t just about knowing trends; it’s about setting them. This field shapes everything from how we handle climate risks to the way we manage healthcare costs and protect data. Leaders in this space are not sitting back—they’re driving innovation, influencing policies, and making sure that as our world changes, our coverages evolve too.

Think of these leaders as your guides through the choppy waters of risk and opportunity. They don’t just wait for change to happen; they see it coming before anyone else does. By using advanced technologies and building strong partnerships across different industries, they’re shaping a future where insurance isn’t just reactive but actually empowers people.

We’ve seen what happens when you combine insight with action: real transformation. And while the landscape might be complex, the direction is clear—forward-thinking strategies that lead not only to growth but also positive societal impact.

I’m thrilled every time I share insights like these because each piece isn’t merely information—it’s fuel for your next big leap in understanding or strategy adjustment in your own work within insurance or any other sector influenced by these shifts.

Here’s what you need to remember: keep challenging norms. The future isn’t set in stone; it’s shaped by leaders willing to innovate and act courageously. Do you have what it takes?