Welcome to the world of insurance thought leadership blog, where the future of insurance gets reimagined every day. Did you know that leveraging big data can drastically transform risk management strategies? It’s a fact that industry leaders are now harnessing to revolutionize customer experiences and drive unprecedented business growth.

In an era marked by rapid technological advancements and evolving market dynamics, staying informed is not just an option—it’s a necessity. Here, we break down complex industry trends into actionable insights. Every piece serves as your guide through the intricate maze of modern insurance practices.

From exploring cutting-edge parametric insurance solutions to unmasking sophisticated fraud schemes with advanced analytics — our focus remains steadfast on empowering professionals like you with knowledge that matters and creating an insurance thought leadership blog that drives resultes.

What Is Insurance Thought Leadership?

At the forefront of the insurance industry, thought leaders are sparking a revolution. They’re pioneering new ideas, debunking old myths, and tackling the complexities of cyber insurance and the vast potential of parametric insurance. By sharing their expertise, they’re empowering insurance professionals to rethink their approach, challenge conventional wisdom, and forge a brighter future for the industry.

Defining Thought Leadership

Thought leadership in insurance involves sharing insights that drive the industry ahead. These thought leaders are known experts who give valuable perspectives on new trends, issues, and possibilities in the insurance world. They keep up with the latest tech and regulatory changes, providing actionable insights to help insurance pros tackle challenges and seize opportunities.

Benefits of Thought Leadership in Insurance

Insurance companies can establish themselves as authorities in their field by demonstrating exceptional thought leadership. When they share valuable insights and showcase their expertise, they build trust with potential clients and stand out from the competition. I’ve seen it happen: one company I worked with boosted its website traffic by 50% and leads by 25% after consistently publishing high-quality, informative blogs and webinars that addressed real-world challenges and provided actionable solutions. That’s the power of insurance thought leadership.

Key Characteristics of Insurance Thought Leaders

Top insurance thought leaders have a deep knowledge of the industry, a forward-thinking mindset, and the ability to explain complex ideas in a clear, compelling way. They avoid jargon overload and focus on delivering genuine insights that help insurance pros do their jobs better and stay ahead of the curve. Successful thought leaders often share common traits like a passion for continuous learning, a willingness to challenge the status quo, and skill in building strong audience relationships through authentic engagement.

Top 10 Reasons Why People Hate Insurance Thought Leadership

Let’s be real. Not all insurance thought leadership is created equal. In fact, there are some pretty valid reasons why people might roll their eyes at the mere mention of it. Here are the top 10 offenders:

- Lack of originality

- Overly promotional content

- Failure to address real-world challenges

- Jargon overload

- Inconsistent quality

- No practical, actionable insights

- Zero audience engagement

- Shameless self-promotion

- Questionable credibility

- Failure to adapt to industry changes

Insurance thought leadership, when done authentically, can be a game-changer. By sharing genuine insights, industry professionals can better grasp the evolving landscape of insurance, including the complex world of future risk and cyber insurance, as well as strategic approaches to catastrophe risk.

How to Demonstrate Effective Insurance Thought Leadership

Want to show you’re a true insurance thought leader? It’s not just about having a fancy title or a big platform. It’s about delivering real value to your audience.

Establishing Expertise in the Insurance Industry

In the insurance industry, establishing yourself as an expert takes more than just experience – it requires a relentless pursuit of knowledge and a passion for staying informed. Those who rise to the top of their field continually seek out fresh insights, strive to innovate, and always back their claims with solid evidence. Meanwhile, those stuck in bad habits get left behind.

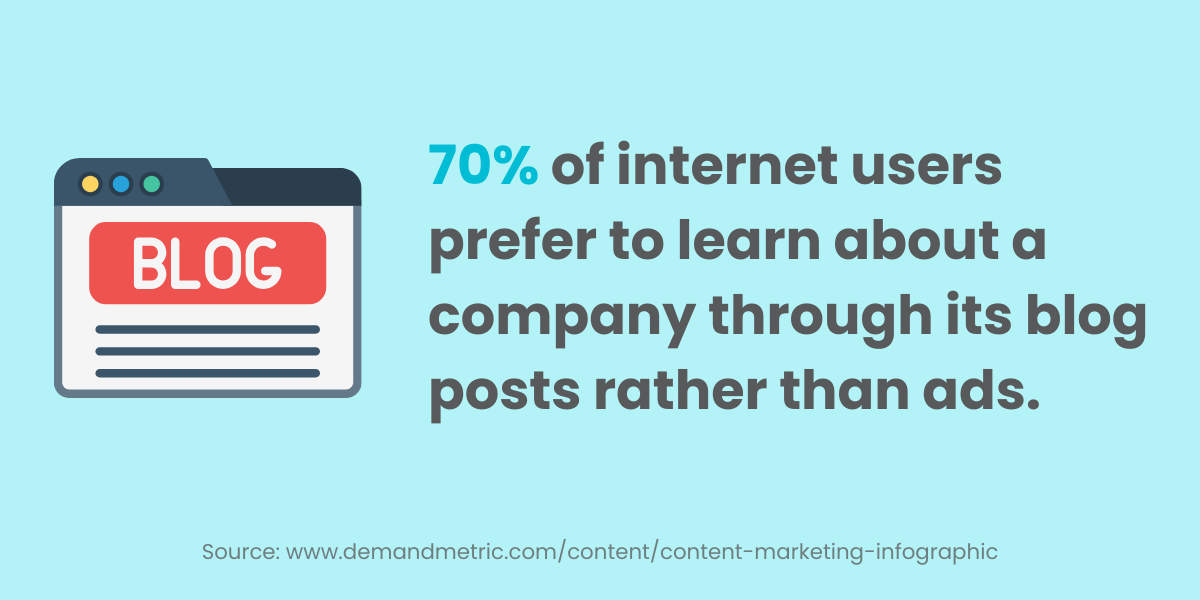

Communicating Thought Leadership Across Media Channels

Insurance thought leadership requires a strategic mix of content types and channels. By leveraging blogs, articles, whitepapers, webinars, podcasts, and social media, you can adapt your message to resonate with diverse audiences while maintaining a consistent brand voice. A balanced approach that combines in-depth guides with bite-sized social media posts helps you engage with your audience regularly while still delving into complex topics.

Adopting a Long-Term Thought Leadership Strategy

Successful insurance thought leadership is a marathon, not a sprint. Develop a content calendar aligned with your business goals. Consistently create and share valuable insights over time. Engage with your audience, respond to feedback, and continuously refine your strategy based on performance metrics. Avoid the temptation to chase short-term trends or engage in one-off campaigns that lack strategic focus.

The Value of Insurance Thought Leadership for Business Growth

Establishing thought leadership in the insurance industry can have a significant impact on your company’s financial performance. It’s not just aPeripheral advantage, but a crucial element in driving business success.

Enhancing Customer Experience and Engagement

In a sea of generic insurance providers, thought leaders are cutting through the noise by offering tangible value to their customers. By sharing expertise and providing practical guidance on achieving effective claims payments, they’re establishing themselves as trusted authorities in the industry. This approach not only elevates the customer experience but also opens the door to new business opportunities for forward-thinking insurance companies.

Improving Risk Management Strategies

Effective insurance thought leadership can help companies improve their risk management strategies. By sharing insights on emerging risks, best practices for risk assessment and mitigation, and innovative solutions, thought leaders can help insurance professionals better protect their clients and businesses. For example, sharing strategies to navigate high-frequency losses post-disaster or prevent insurance fraud can make a real difference in how insurers manage risk.

Driving Innovation in the Insurance Industry

Insurance thought leaders play a key role in driving innovation in the industry. By exploring topics like insurtech, AI, and blockchain, they inspire insurance professionals to embrace change and adopt new solutions that can improve efficiency, cut costs, and enhance customer value. Thought leaders who stay on the cutting edge of industry disruption and share actionable insights are invaluable in helping insurance companies stay competitive.

Examples of Successful Insurance Thought Leadership Strategies

Need some inspiration for your own insurance thought leadership efforts? Look no further than these real-world examples.

Case Studies of Effective Insurance Thought Leadership

One standout example is the “Insights” section of the Marsh website. It features a wide range of articles, reports, and webinars on topics like cyber risk, climate change, and pandemic response. By providing in-depth analysis and practical guidance, Marsh has established itself as a trusted resource for insurance professionals and business leaders. Another great example is the “ITL Focus” series from Insurance Thought Leadership, which dives deep into a different timely topic each month, from predicting healthcare costs to preventing insurance fraud.

Lessons Learned from Industry Leaders

Successful insurance thought leaders often share common traits:

- A deep passion for the industry

- Commitment to continuous learning

- Willingness to challenge the status quo

- Ability to translate complex ideas into accessible insights

- Skill in building strong audience relationships through authentic engagement

I’ve been fortunate enough to learn from the best, including ITL Editor-in-Chief Paul Carroll and seasoned insurtech veteran Callie Thomas. What I’ve come to realize is that thought leadership is all about giving back – sharing your expertise to help others rise to the top.

Emerging Trends in Insurance Thought Leadership

The insurance thought leadership landscape is constantly evolving. Here are some of the key trends to watch:

Leveraging Big Data and Analytics

Showcasing insurance thought leadership means more than just aggregating data – it’s about crafting insightful narratives that resonate with customers. By wielding the power of big data and analytics, forward-thinking leaders can decipher the code of customer behavior, expose hidden risks, and articulate decisive market strategies that blaze a trail for others to follow.

Addressing Cyber Risks and Insurance

Cyber threats are escalating, and insurance thought leaders are sounding the alarm. To protect their assets, companies need expert guidance on managing cyber risk, incident response planning, and coverage options. The top minds in the industry are sharing real-world strategies for spotting phishing emails, conducting penetration tests, and safeguarding against ransomware attacks – insights that could mean the difference between disaster and resilience.

Exploring Parametric Insurance Solutions

Imagine a type of insurance that pays out quickly and transparently, without the need for a lengthy claims process. This is the promise of parametric insurance, a rapidly evolving area of interest that’s set to transform the way we approach risk transfer. By sharing real-world examples, success stories, and expert insights, thought leaders can drive adoption and innovation in this exciting new field.

Combating Insurance Fraud

Insurance fraud remains a major challenge, costing billions each year and eroding trust. Insurance thought leaders are exploring new strategies and technologies for detecting and preventing fraud, such as machine learning, blockchain, and behavioral analytics. Sharing insights and best practices can help combat this persistent threat. Thought leaders who can provide guidance on how to identify and prevent common types of fraud, like disaster fraud or fraudulent claims, will be highly valued by insurance companies looking to protect their bottom line.

The Future of the Insurance Thought Leadership Blog

As the insurance industry evolves, so too must the role of the insurance thought leadership blog. Here’s what the future may hold:

Evolving Role of Insurance Thought Leadership Blogs

The future of insurance thought leadership blogs is all about connection. To truly make a mark, these blogs will need to swap information overload for impactful insights, swapping likes for meaningful conversations, and anonymous clicks for genuine community building. The ultimate goal? Sparking industry-wide change through inclusive, tech-savvy engagement.

Predictions for the Future of Insurance Thought Leadership

Looking ahead, insurance thought leadership will become even more crucial as the industry faces unprecedented challenges and opportunities. From the impact of climate change to the rise of autonomous vehicles, thought leaders will need to be at the forefront of these trends, providing insights and guidance to help the industry navigate uncharted waters.

Staying ahead of the curve means embracing innovative content formats, such as virtual and augmented reality, voice-powered interfaces, and tailored content experiences. Insurance thought leaders who do this will be able to tap into their audience’s evolving needs and preferences, serving up insights in the most engaging and accessible ways possible.

In the ever-changing landscape of insurance, thought leaders have a unique chance to leave their stamp on the industry. By embracing innovation and taking calculated risks, they’ll not only navigate the challenges ahead but also forge a new path forward. I’m excited to see the pioneers who will shape the course of insurance thought leadership.

Insurance thought leadership involves sharing innovative ideas to drive the industry forward. By addressing real-world challenges and providing actionable insights, experts can help improve efficiency, cut costs, and enhance customer value.

Conclusion

Insurance thought leadership isn’t just about knowing the trends; it’s about shaping them. Through this insurance thought leadership blog, we’ve explored how true leaders in the industry don’t just follow the map—they draw one.

To stay ahead of the curve, companies are embracing bold strategies – think leveraging big data and addressing cyber threats. The payoff? Richer customer relationships, accelerated business growth, and a reputation as a trailblazing leader.

Those successful strategies we mentioned earlier? They’re not just feel-good stories – they’re actionable guides for turning risk and customer service on their heads, with a ripple effect that resonates through revenues and reputations.

As we explore the uncharted territories of insurance thought leadership, every article becomes a catalyst for growth, innovation, and disruption. You’re not just reading – you’re equipping yourself to take the reins, to craft a reality that’s unparalleled in our industry. The future is now, and we’re writing its story together.