If you want to succeed in the mortgage industry, having a solid marketing plan is key. Lenders who actively engage in new mortgage marketing ideas and strategies attract a greater pool of potential clients, leading to a stronger business.

However, with so many marketing channels and tactics available, it can be challenging to know where to focus your efforts. That’s where proven mortgage marketing ideas come into play. By leveraging the right strategies and tools, you can reach your target audience, build trust, and ultimately close more deals.

Taking your mortgage company to the next level requires a strategic approach to marketing. We’ll explore the most effective mortgage marketing ideas, from social media campaigns to content creation and referral partnerships, to help you attract more clients and grow your business.

10 Effective Mortgage Marketing Ideas to Boost Your Business in 2024

As a seasoned mortgage industry professional, I’ve seen firsthand how implementing the right mortgage marketing ideas can skyrocket your business growth. In today’s competitive landscape, mortgage companies need to think outside the box to attract potential clients and build brand awareness.

If you’re tired of mediocre results in your mortgage business, revamping your approach is key to succeeding in today’s competitive market. Mortgage lenders and loan officers can look forward to new heights this year by implementing our expert-approved tactics and strategies.

1. Leverage Social Media Marketing to Engage Your Target Audience

In the fast-paced world of marketing, mortgage pros are discovering the power of social media platforms like Facebook, Instagram, TikTok, and LinkedIn. By crafting targeted campaigns, they’re speaking directly to their ideal customers, blending their brand’s voice with compelling messaging that really resonates. And with people browsing online, mortgage companies are delivering tailored solutions that simplify the mortgage process.

To make the most of social media marketing, focus on creating engaging content that educates and informs your audience. Share helpful tips, industry insights, and success stories that showcase your expertise and build trust with potential clients.

Amplify your reputation in the mortgage industry by consistently crafting informative content and leveraging social media to engage with your audience, culminating in a strong online presence that draws in potential clients to your business.

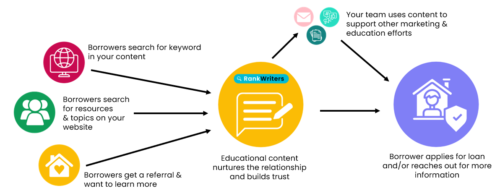

2. Create Valuable Content to Attract and Educate Potential Clients

Content marketing is another essential strategy for attracting and educating potential clients in the mortgage industry. By creating helpful blog posts, videos, infographics, and other types of website content, you can position yourself as an authority in your field and build trust with your target audience.

Soften up your content marketing strategy by tackling topics that resonate with potential clients. This means tackling common pain points and offering step-by-step guides, like breaking down the mortgage process into bite-sized pieces. Connect with viewers by explaining loan options in a straightforward, no-jargon sense, just like experts explain concepts in casual conversation.

Gearing up your mortgage marketing efforts with a well-planned content strategy is crucial. It helps not only in generating new leads but also fosters a loyal following of engaged readers who are more likely to become clients in the long run.

Harvest potential clients by sowing seeds of value through social media and content marketing, providing helpful tips, industry insights, and success stories that showcase your expertise, and watched your business bloom with qualified leads and deals.

3. Implement Email Marketing Campaigns to Nurture Leads

In the world of mortgage marketing, it’s the little things that count. A well-crafted email campaign can make all the difference in turning potential clients into loyal customers. Whether it’s updating mortgage rates or offering exclusive deals, email marketing can help you stay top of mind.

In order to connect with potential clients, create a valuable lead magnet related to the mortgage process, such as a free guide or calculator. Once you’ve gathered their email addresses, send targeted campaigns that educate them about their options and showcase your expertise.

Segment your mailing list to send the right message to the right person at the right time. For example, create one sequence for first-time homebuyers and another for experienced investors seeking creative financing options. Email marketing is automated, so you can set up nurture sequences once and track opens, clicks, and conversions to optimize your campaigns.

4. Collaborate with Real Estate Agents for Referral Marketing

Partnering with real estate agents for referrals is one of the best mortgage marketing strategies. Real estate agents work with homebuyers every day who need financing, making it a win-win situation as you provide great service to their clients.

To get on an agent’s radar, attend local real estate events and introduce yourself. Offer to sponsor an open house or provide educational content for their website or social media. Create a referral program that rewards agents for sending business your way, such as a cash bonus per closed loan or a gift card to their favorite restaurant.

Stay top of mind with your referral partners by keeping in touch regularly. Send them market updates, industry news, or a quick note to check in. Providing value increases the likelihood of them continuing to send referrals your way.

5. Optimize Your Website for Search Engines and User Experience

As a mortgage professional, your website is often the first point of contact between you and potential clients. This initial interaction can make or break the chances of converting them into customers. With this in mind, it’s crucial that your website not only ranks well in search engines but also provides a seamless user experience.

A simple yet critical aspect of this is ensuring your site is mobile-friendly. Considering most people access the internet through their smartphones, a responsive design is no longer a luxury, but a necessity. This minimal investment can make a significant difference in attracting and engaging potential clients.

Another often-overlooked aspect is the loading speed of your website. A slow or clunky site can be a major turnoff for potential clients. In today’s fast-paced digital world, people expect instant access to information. If your site takes too long to load, you risk losing potential clients to your competitors.

In addition to these basics, it’s essential to provide a user experience that caters to diverse client needs. This means designing a website that effectively communicates your services, provides valuable resources, and makes it easy for clients to take the next step. By focusing on these critical elements, you can create a website that not only attracts potential clients but also sets you apart from the competition.

Want to know how to implement SEO? Download our FREE eBook for Lenders!

6. Utilize Video Content to Showcase Your Expertise and Services

Video content is a powerful tool for mortgage marketing. It allows you to showcase your expertise and services in an engaging and easy-to-understand way. Creating video content is a great method to connect with potential clients and build trust.

When creating video content, focus on breaking down the mortgage process into simple, easy-to-digest concepts. For example, you could create a series of videos that walk people through the steps of getting a mortgage loan, from pre-approval to closing. This provides valuable information that helps people feel more confident about the process.

When crafting compelling video content, remember these simple yet effective tips to captivate your audience.

- Keep videos short and sweet, aiming for 2-3 minutes in length.

- Use clear, concise language and avoid jargon and technical terms.

- Include a call-to-action encouraging viewers to take the next step.

- Optimize for search engines using relevant keywords in titles, descriptions, and tags.

7. Implement Marketing Automation to Streamline Your Efforts

The minutes in a mortgage professional’s day are always ticking away. To maximize your impact, marketing automation can streamline your efforts, freeing you to focus on nurturing those all-important client relationships. With the ideal mortgage marketing tools, you can skillfully cultivate leads and deliver targeted messages at just the right moment.

- Lead generation: Use landing pages and contact forms to capture leads.

- Email marketing: Create targeted email campaigns to nurture leads.

- Social media: Schedule posts in advance and monitor engagement.

- Reporting: Track key metrics to optimize your campaigns over time.

Fortify your marketing game by selecting the most effective digital mortgage marketing tools. An optimal automation platform will sync perfectly with your existing systems, offer informative reporting and analytics, and encourage growth through success.

8. Build a Strong Online Presence with Google Business Profile

Mortgage professionals can unlock the power of online search with a Google Business Profile. This all-important tool enables you to manage your business information across Google, ensuring customers receive accurate and reliable information about your services.

When potential clients search for mortgage-related keywords in your area, your Google Business Profile can appear in the search results. This allows you to showcase your expertise and services, encouraging people to learn more about your business. To optimize your profile, complete all information fields, add photos and videos, encourage client reviews, and post regular updates.

Create content that puts your mortgage expertise on full display. When you consistently share high-quality blog posts, videos, infographics, or podcasts, you’re more likely to attract a loyal following and establish yourself as a trusted authority in the mortgage industry.

Building a strong online presence takes time and effort, but the payoff can be significant in terms of generating leads and growing your business. By leveraging tools like Google Business Profile and creating valuable content, you can attract more leads, build trust with potential clients, and ultimately grow your mortgage business.

Create engaging video content that educates and showcases your expertise, like a trusted guide navigating the complex mortgage process, helping potential clients feel more confident and building trust with your audience.

9. Develop a Comprehensive Mortgage Marketing Strategy

As a mortgage marketing professional with over a decade of experience, I’ve seen firsthand the power of a well-crafted mortgage marketing strategy. It’s not just about throwing spaghetti at the wall and seeing what sticks.

You need a comprehensive plan that covers all the bases – from defining your target audience to leveraging the right mix of marketing channels.

Identify Your Target Audience

First things first: who are you trying to reach? Get crystal clear on your ideal client profile. What’s their age range, income level, and homeownership status?

The homebuying process can be daunting, with many prospects struggling to navigate the complexities of mortgage financing. Lenders seeking to engage this demographic must start by empathizing with their potential clients’ pain points and aspirations. Only then can they tailor their marketing efforts to speak to their unique needs and goals.

Effective branding in the mortgage industry is a delicate balance between conveying expertise and providing value to customers. By showcasing your team’s knowledge and commitment to transparent mortgage solutions, you can create a sense of security and foster loyalty among clients.

Leverage a Mix of Marketing Channels

In today’s digital age, crafting a successful marketing strategy demands a multimedia approach that takes into account the diverse online behaviors of our audience. This means fostering a rich tapestry of messages across multiple channels, thoughtfully crafted to resonate with our online companions.

- Content marketing (blog posts, videos, infographics).

- Email marketing (newsletters, drip campaigns).

- Social media marketing (organic posts, paid ads).

- Referral partnerships (real estate agents, financial advisors).

Your online presence starts with telling a story that’s genuinely yours. When your words resonate across different screens, something beautiful happens – your brand’s true character shines through. This is how you create a lasting impression that sets you apart.

Measure, Analyze, Optimize

Finally, don’t just set it and forget it. The most successful mortgage marketing ideas and strategies are the ones that evolve over time based on data and insights.

Getting to the heart of your website’s performance means keeping a close eye on your traffic, conversion rates, and top-performing content. It’s also crucial to monitor your email open rates and click-through rates to gauge what’s resonating with your audience.

Continuously test and optimize your mortgage marketing ideas to see what works best for your unique mortgage business. The mortgage industry is always changing – and so should your approach to digital marketing.

10. Continuously Analyze and Refine Your Mortgage Marketing Efforts

I’ll let you in on a little secret: the most successful mortgage professionals are the ones who never stop learning and adapting. They understand that mortgage marketing is an ongoing process – not a one-and-done task.

Set Clear Goals and KPIs

Transforming mortgage marketing efforts begins with defined goals that breathe life into your marketing approach. Establish concrete objectives that seamlessly connect with your business aspirations.

For example, maybe you want to increase your website traffic by 25% over the next quarter. Or generate 50 new mortgage leads per month from your email marketing campaigns.

Once you have your goals in place, identify the key performance indicators (KPIs) that will help you track progress. This could include metrics like:

- Website traffic

- Conversion rates

- Cost per lead

- Customer acquisition cost

- Return on ad spend

Analyze and Adjust Your Strategy

If you’re eager to scale your marketing efforts, it’s time to find your treasure: rich, actionable data. Break out your analytics tools and drill down into the numbers to unearth valuable insights. A marketing masterclass starts with metrics: it’s time to get down to business.

Better insights can be the game-changer your strategy needs. Take Facebook ads, for example. If you’re driving a ton of traffic but seeing little to no conversions, it’s likely time to refocus your targeting or give your ads a tune-up.

Or if you see that a particular blog post is getting a ton of engagement, consider creating more content around that topic or repurposing it into other formats like a video or infographic.

Stay Ahead of Industry Trends

Staying up-to-date with the mortgage industry’s constant evolution is essential for adapting your marketing strategy and ensuring it remains effective.

Knowledge is continuously upping the game in digital marketing. Attend conferences and join online groups focused on your niche, regularly staying updated on best practices and network ideas with thought leaders – simply know what others know about successful marketing efforts.

When you’re ahead of the curve, you’ll be well-prepared to adjust your mortgage marketing strategies and stay ahead in a market that’s constantly evolving. Leverage marketing automation tools to simplify your workflow and focus on building meaningful relationships with potential clients.

Key Takeaway:

Optimize your mortgage marketing strategy by identifying your target audience and creating a mix of marketing channels that resonate with them, then continuously analyze and refine your efforts based on data insights, adapting to industry trends and evolving your approach to stay ahead in the competitive market.

Conclusion

Implementing effective mortgage marketing ideas is crucial for the success and growth of your mortgage business. By leveraging strategies such as social media marketing, content creation, email campaigns, and referral partnerships, you can reach your target audience, build trust, and ultimately close more deals.

Pursuing effective mortgage marketing methods requires dedication and perseverance. It’s not a one-and-done deal – you need to continually adapt your strategy, monitor your results, and adjust your approach to optimize your mortgage marketing efforts.

Raise the bar on your mortgage marketing efforts by focusing on building lasting relationships with your clients and referral partners. Offer tailored guidance, stay up-to-date on industry developments, and always prioritize your clients’ needs.

Leverage effective mortgage marketing ideas and watch your business thrive. A customer-centric approach, combined with creativity and dedication, is the recipe for attracting more clients and achieving long-term success in the competitive mortgage lending market.