The mortgage market has gone digital, and smart mortgage professionals are adapting to new marketing strategies. Instead of pounding the pavement or relying solely on cold calls, they’re turning to mortgage marketing content to draw in new clients. Imagine relaxing on your couch, sipping your morning coffee, while your expertly-crafted content diligently works in the background, pulling in a steady flow of potential homebuyers.

This approach is all about positioning yourself as a reliable source of information, connecting with people online, and nurturing them throughout their home buying journey. Meeting your target audience where they are already spending their time, such as social media or searching for solutions online, just makes good business sense. This means developing impactful mortgage marketing content that ranks well on Google, piques their interest, and encourages them to learn more from you about securing a mortgage. Let’s break down how to make this happen.

What Makes Mortgage Marketing Content So Powerful?

Imagine the experience of a first-time home buyer. This individual might feel a mix of excitement and uncertainty when venturing into unfamiliar territory, grappling with questions like:

- What steps are involved in obtaining a mortgage?

- Which type of mortgage is right for my circumstances?

- How do I even begin this process?

These are all questions mortgage marketing content can proactively address. Content presents a prime opportunity to equip potential buyers with the knowledge and resources they crave.

This approach isn’t about tossing out generic facts about interest rates or loan options. Focus on genuinely connecting with readers’ emotions, calming their nerves, and instilling a sense of trust and confidence in your expertise. When your content speaks directly to the hearts and minds of those considering one of life’s biggest financial decisions—buying a home—you begin building strong, long-lasting relationships that extend well beyond a simple transaction.

Tailoring Your Message: Who are you talking to?

When it comes to successful mortgage marketing content, you can’t just post generically about mortgages and hope for the best. Effective communication hinges on identifying and understanding your ideal customer. Are you primarily targeting first-time home buyers, seasoned homeowners looking to refinance, or those seeking out specific mortgage types, such as jumbo loans, reverse mortgages or non-QM loans?

You might also focus some content on building stronger bonds with referral partners, such as real estate agents, financial advisors, and other industry professionals. These referral partners can steer quality leads in your direction. Each group brings its own set of needs, concerns, and pain points.

The language and information shared needs to resonate with those specific circumstances to make a true impact. Once you determine your primary target audience, craft your content in a way that specifically addresses their unique needs and challenges, providing valuable insights and solutions that matter most to them. For instance, your content could break down complex terminology into easily digestible explanations, offering real-life scenarios that resonate with your intended audience.

Getting Down to Brass Tacks: 3 Key Pillars for Success

1. Engaging and Informative:

Crafting compelling mortgage marketing content requires more than simply throwing together a few sentences about mortgage rates. It demands a strategic blend of informative and engaging material. This material needs to provide genuine value to your audience and make them feel excited to embark on this significant journey with you.

A dry, overly technical blog post on the various nuances of amortization schedules is unlikely to hold anyone’s interest. One way to captivate readers with your carefully crafted content is through powerful storytelling. Try weaving real-life examples of past clients into your narratives.

Showcasing your expertise while maintaining a reader-friendly tone is paramount. For instance, you might write a blog post titled “5 First-Time Home Buyer Mistakes to Avoid,” including clear and easy to implement steps readers can take to navigate the process more successfully. For those intimidated by financial jargon, craft content like “Decoding the Mortgage Maze: Explaining Common Terms in Plain English,” aiming to build confidence in their understanding of often confusing financial terminology. By sharing actionable advice and information, you’ll position yourself as the go-to expert in all things mortgages, inspiring potential borrowers to entrust you with one of their most significant financial milestones. This way, you not only keep readers hooked with captivating stories and a conversational tone but also position yourself as an expert they can trust throughout their homebuying process.

2. SEO: Getting Your Content in Front of the Right Eyes

You could have the best mortgage marketing content in the world, but it won’t do you much good if it sits there unseen. Search engine optimization, better known as SEO, plays a vital role in amplifying your mortgage content. SEO focuses on optimizing your online content to improve your website’s ranking within search results on platforms like Google. When people search for keywords related to mortgages and you rank well for those, they will be far more likely to find you. The better your content ranks, the greater your chance of connecting with eager prospective clients actively seeking out mortgage solutions.

Start with comprehensive keyword research, think “first-time home buyer programs,” “mortgage refinance options,” or perhaps even long-tail keywords like “how to find a reputable mortgage loan officer in [insert city or region here].” Incorporate these targeted keywords organically within your headers, body content, and even image alt text, ensuring those vital terms sound natural within the flow of your writing.

By naturally incorporating those high-value phrases people actively search for into your well-crafted content, your mortgage website is much more likely to achieve a top spot in search results. “SEO-optimized, long-form content is really where we spend a lot of time,” stated Marisa Carey, Business Development & Marketing Manager at NFM Lending, during her conversation on the Niche Marketing Podcast. SEO isn’t just a checkbox; it requires ongoing attention, strategic tweaking of existing content, and thoughtful content planning. Think of it as consistently watering your metaphorical content garden to help it flourish in those Google rankings.

Keep in mind: your long-form blog content is more than just a single piece of writing. It’s a central content hub that can be repurposed and reused across various digital marketing channels, like social media marketing, video marketing, and email marketing. By repurposing your long-form blog content, you can extend its shelf life, reach new audiences, and drive more engagement. So, get creative and start maximizing your content’s potential for lead generation!

3. Building Authority and Trustworthiness

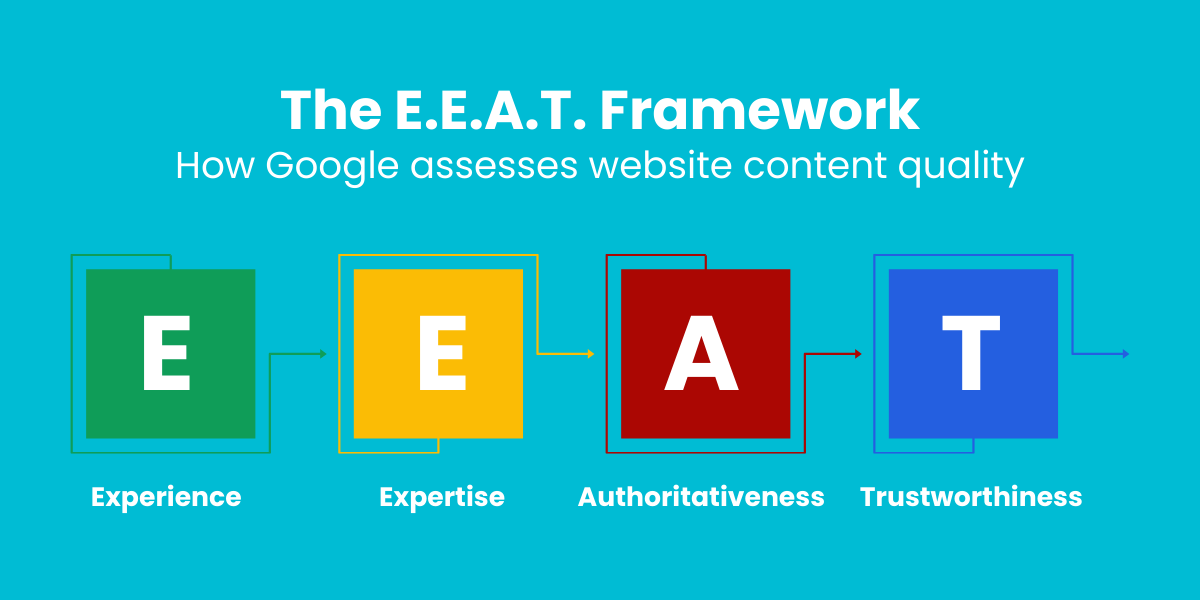

The world of mortgage lending can be complex. People want to feel assured the expert they’re placing their trust in is both knowledgeable and dependable. E-E-A-T, a core concept behind Google’s search algorithms, provides crucial guidance in cultivating trust and showcasing expertise through your digital content. But what does E-E-A-T entail?

| Element of E-E-A-T | How to Convey in Mortgage Content |

|---|---|

| Expertise | Showcase in-depth knowledge of mortgage products, processes, industry trends, and financial regulations. Consider collaborating with experienced underwriters and loan processors on certain content pieces. |

| Experience | Share real-life success stories demonstrating expertise in securing mortgages for your clients. Use data and facts about loan closings from your team (with any private information redacted). |

| Authoritativeness | Include links to relevant, respected sources like industry publications, government websites (.gov), and respected news outlets, which all support your content. Highlight professional credentials held by members of your team, such as licenses, awards, and years of experience. Consider getting interviewed on a podcast or contributing as a guest writer to other blogs in the mortgage niche. |

| Trustworthiness | Establish credibility with a professional website design that instills confidence and trust. Prioritize prompt and helpful communication with your leads. Secure testimonials and reviews from past clients to feature as social proof. |

By focusing on these four key areas, you will not only gain favor with Google’s algorithms for a better ranking but you’ll establish credibility, build authority as a mortgage expert, and solidify that crucial trust with those considering doing business with you.

FAQs About Mortgage Marketing Content

How much should you spend on a mortgage marketing budget?

This depends. As with many marketing budgets, you can decide to base it on a percentage of revenue. Most importantly, you need to secure enough capital to accomplish your objectives. Are you focusing only on SEO with a team writing mortgage blog content, or do you need to factor in paid advertising, video creation and editing, website hosting, and other marketing costs? Creating videos, running ads, and producing other forms of media marketing can support your content marketing efforts.

How long does it take to see results from mortgage marketing?

This also depends. Like growing a garden, mortgage marketing often demands patience and a long-term view. You won’t see instantaneous results, as exciting as those would be. Some methods like paid ads may yield more immediate results but cost money. Whereas approaches such as blogging and search engine optimization can take a bit longer to gain traction—potentially several months—to build trust and start attracting consistent, high-quality leads, because content marketing and SEO are marathon activities, not sprints. By understanding your objectives and ideal timeline, you can plan accordingly and budget for necessary services.

Conclusion

The world of mortgage lending is constantly evolving, just like life. Savvy mortgage loan originators are choosing to move away from solely traditional approaches like cold-calling and door knocking in favor of embracing innovative approaches such as digital mortgage marketing content. These mortgage companies and loan officers know that the long-term, sustainable results of content marketing far outweigh less efficient methods. As people turn online in droves for solutions to life’s big decisions, consider this your formal invitation to reach them in a whole new way that emphasizes empathy and knowledge. Build authority and trust by sharing valuable mortgage content strategically and consistently to position yourself as the go-to expert, watching as those well-qualified leads start pouring in.

Conclusion

The mortgage industry is competitive. That is why it is important to invest in your business and market it appropriately. Using a well-defined content marketing strategy for mortgages, you can create and distribute valuable, relevant, and consistent mortgage marketing content. This content will not only increase sales but generate leads for the lifetime of your mortgage business.