Hey mortgage pros, let’s get real – in a crowded industry, standing out is tough. But that’s exactly what you need to do to stay ahead. You know the drill: matching the right mortgage marketing approach with the right borrower. It’s a tricky balance, but someone’s gotta do it.

In today’s mortgage landscape, a solid marketing plan is non-negotiable – whether you’re a seasoned vet or just starting out. Want to boost your online presence, build trust with potential clients, and (oh yeah) close more loans? You need a plan that combines the old-school with the new.

Stick with us, and we’ll break down the essentials of a killer mortgage marketing strategy – plus some handy tips to take your business to the next level.

Table Of Contents:

- What is Mortgage Marketing?

- Top 5 Mortgage Industry Marketing Strategies

- Mortgage Lead Generation and Management

- Developing a Mortgage Marketing Plan

- An Example Mortgage Marketing Plan

- Digital Marketing for Mortgage Companies

- SEO for Mortgage Companies

- Conclusion

What is Mortgage Marketing?

Mortgage marketing is all about making yourself visible to potential clients and showcasing why they should choose you for their mortgage needs.

Pinning down the perfect mortgage marketing strategy can be a challenging task, but exploring a mix of traditional and digital methods can lead to a harmonious blend that drives results. From print ads to blog posts to social media campaigns, the key is to find a balanced approach that speaks to your target audience.

Traditional Mortgage Marketing Methods

No matter how digital marketing efforts gain popularity, traditional methods never go out of style. In today’s marketing landscape, print ads, direct mail campaigns, and even signage along major roads still provide viable alternatives for reaching mortgage seekers, particularly when concentrated efforts target localized audiences.

Marketing on a budget requires a strategic approach. Don’t be blindsided by flashy advertising, carefully considering your financial situation and goals is key. Ensure you weigh the costs and benefits of traditional methods to make the most of your marketing efforts.

Digital Marketing Methods

Analogous to the demise of traditional phone books, the rise of digital marketing has completely altered the way people search for and secure mortgages. Mortgage companies must shift their focus to cater to this digitally-driven society.

Savvy mortgage lenders have turned to digital marketing to spark awareness and drive interest in their mortgage products, leveraged strategies like social media, blog articles and email campaigns to successfully reach their target audience.

- Building a user-friendly website with valuable ongoing content and clear calls-to-action

- Using social media to engage with potential clients and share helpful resources

- Running targeted online ads to reach people who are actively searching for mortgage solutions

- Sending email campaigns to nurture leads and stay top-of-mind with past clients

Mortgage Marketing Overwhelm

If you’re feeling overwhelmed by the numerous mortgage marketing options out there, you’re not alone. With so many paths to explore, it can be challenging to determine which strategies will best support your business.

A firm foundation is built on solid ground. Before taking the first step, you need to define your target audience, establish clear goals, and choose the tactics that align with your budget and resources. Resist the urge to try to tackle everything at once – focus on a few core strategies and build upon them.

Create a culture of continuous improvement by monitoring your online metrics. Gauge the success of each initiative by using data visualizations and logarithmic graphics. By streamlining your workflow and making informed decisions, you’ll develop a powerful marketing framework that propels your online presence forward.

Top 5 Mortgage Industry Marketing Strategies

Now that we’ve covered the basics of mortgage marketing, let’s dive into some specific strategies that can help you attract and convert more leads.

1. Social Media in Mortgage Marketing

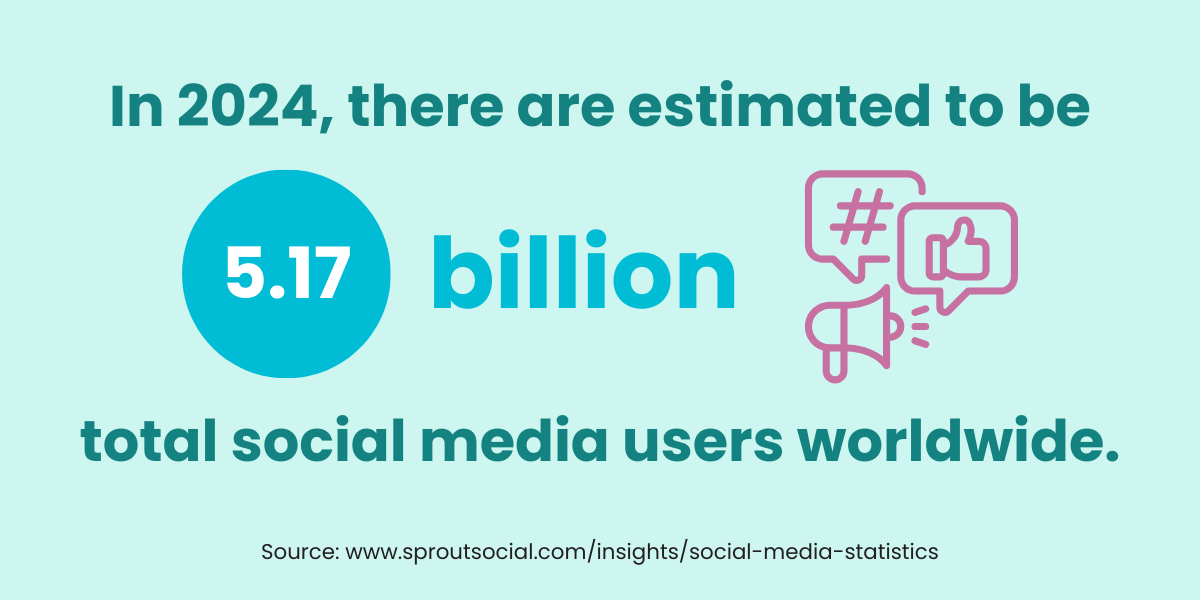

Rethinking the traditional marketing strategy, mortgage professionals are now using social media platforms like Facebook, Instagram, TikTok, and LinkedIn to connect with potential clients. By sharing valuable content and building a personal brand, they’re establishing themselves as thought leaders in the industry.

Did you know that shifting economic trends have the power to directly affect the housing market and mortgage rates? Smart professionals, aware of these fluctuations, can utilize social media to disseminate crucial information and foster a lasting reputation as a credible authority.

2. SEO & Content Marketing in the Mortgage Industry

Content marketing is a powerful tool for mortgage companies looking to attract and engage potential borrowers. By creating valuable, informative content, you can establish your brand as a trusted resource in the industry and build relationships with your target audience.

One effective content marketing strategy for mortgage companies is to create educational blog posts and articles (that are optimized for search) that answer common questions and address concerns that borrowers may have. This could include topics like:

- How to qualify for a mortgage

- The different types of mortgages available

- Tips for improving your credit score

- The home buying process from start to finish

By providing this type of helpful information, you can demonstrate your expertise and build trust with potential clients. You can also use your content to showcase your unique value proposition and explain why borrowers should choose to work with your company.

3. Email Marketing and Co-Branding in Mortgage Marketing

Email marketing is a highly effective way to nurture leads and stay top-of-mind with past clients. By sending targeted, personalized emails, you can build relationships and drive repeat business.

Innovative email marketing tactics like co-branding involve partnering with other companies to grow your lead list. For instance, you might collaborate with a real estate website to collect contact information from homebuyers in your target area.

4. Paid Advertising in Mortgage Marketing Strategy

Generating leads often requires a boost of strategic paid advertising. By creating engaging ad copy and clever landing pages, you can effectively direct traffic to your website.

5. Building Relationships in Mortgage Marketing Strategy

At the end of the day, mortgage marketing is all about forging meaningful connections. Whether you’re chatting with potential clients on social media, sharing insightful content, or nurturing leads through email marketing, the goal is to establish trust and credibility.

Genuine connections aren’t just feelings; they’re pillars of a successful business. Attend local events, host gatherings, and engage with potential clients in person to build strong relationships.

Mortgage Lead Generation and Management

The success of any mortgage marketing strategy ultimately boils down to effective lead generation. Yet, with so many options for generating and managing leads, making sense of it all can be daunting.

Three Unique Online Marketing Methods for Real Estate Lead Generation

Looking for some creative ways to generate mortgage leads online? Here are three ideas to try:

- Create a quiz or assessment that helps potential clients determine their home financing needs and options. Promote the quiz on social media and capture lead information in exchange for the results.

- Partner with local real estate agents to create co-branded content, such as neighborhood guides or home buying checklists. Share the content on both of your websites and social media channels to reach a wider audience.

- Host a webinar or virtual event that educates potential clients on the mortgage process and your unique offerings. Promote the event through email, social media, and paid ads, and collect lead information during the registration process.

4 Best Mortgage Lead Management Software for Loan Officers

Once you start generating mortgage leads, it’s important to have mortgage marketing tools in place to manage and nurture them effectively. Here are four of the top-rated mortgage lead management software options for loan officers:

- Total Expert: This powerful mortgage CRM offers 55+ industry-specific integrations, customizable and automated marketing journeys, print materials like open house flyers and direct mail, and reporting features.

- Velocify: Designed specifically for the mortgage industry, Velocify provides lead distribution, prioritization, and automated follow-up tools to help loan officers close more deals.

- Surefire CRM: This all-in-one platform combines lead management, marketing automation, and sales enablement features to streamline the mortgage sales process.

- Floify: With a focus on collaboration and transparency, Floify helps loan officers manage leads, collect documents, and communicate with borrowers and real estate agents in one centralized platform.

3 Ways Mortgage Lead Automation Helps Get More Leads

In contrast, working with mortgage lead automation tools allows you to chart a clear course for success and guarantees more conversions.

- Automatically capturing and nurturing leads from your website and online marketing campaigns.

- Providing personalized, targeted content to leads based on their behavior and interests.

- Alerting loan officers to new leads and prioritizing follow-up tasks based on lead quality and engagement.

Dreams are made of negotiations, financial hurdles, and a dash of success. A good mortgage lead automation software understands that in the cycle of closing deals, little details can have a big impact. By automating those smaller tasks, you can put your energy into the meat of the matter: building strong relationships and champion deals for your clients.

Developing a Mortgage Marketing Plan

Lasting success in the mortgage market requires a thoughtful strategy. The first step is to define your objectives, pinpoint your target audience, and chart a course for reaching them.

Getting Started with Your Mortgage Marketing Plan

The first step in creating a mortgage marketing plan is to define your goals. What do you want to achieve with your marketing efforts? Some common goals might include:

- Generating a certain number of new leads per month.

- Increasing brand awareness in your local market.

- Nurturing past clients to drive repeat business and referrals.

Beyond articulating your goals, it’s crucial to discern the identities of your target audience members. This could encompass grasping their ages, occupations, professions, afflictions, worries, or anxieties. An understanding of these details empowers you to draft marketing strategies that connect intimately with the people your marketing targets.

Begin by Planning Your Mortgage Marketing Budget

Calculate how much you’re willing to spend on marketing each month or quarter, and consider the top initiatives you want to support with your budget. With a clear idea of your marketing spending, you’ll be able to direct resources more efficiently.

“Be prepared to allocate funds for everything from recurring expenses like website hosting and social media management to one-time expenditures like brochures and trade show appearances. Don’t forget to leave some room in your budget for experimentation and testing new approaches.

An Example Mortgage Marketing Plan

Building a mortgage marketing plan means translating the value proposition into action, crafting a pathway to attracting and retaining customers.

- Goal: Generate 50 new leads per month

- Target audience: First-time homebuyers in the local area

- Strategies:

- Develop a user-friendly website with educational content and clear calls-to-action

- Run targeted Facebook and Google ads to reach potential clients

- Partner with local real estate agents to host homebuyer seminars and workshops

- Send monthly email newsletters with helpful tips and resources

- Budget: $2,500 per month

What to Include in Your Mortgage Marketing Plan

As you build your mortgage marketing plan, don’t overlook some essential pieces of the puzzle. In addition to your goals, target audience, strategies, and budget, be sure to outline the specifics of how you’ll reach and engage with your audience.

- A timeline for implementing each tactic.

- Metrics for measuring success (like website traffic, lead volume, or conversion rates).

- A plan for tracking and analyzing results.

- Contingency plans for adjusting your approach if needed.

Remember, your marketing plan should be a living document that you revisit and update regularly based on your results and changing business needs.

Digital Marketing for Mortgage Companies

Having an authoritative online presence is no longer a luxury, but a necessity for mortgage lenders. A well-crafted online strategy can provide the spark that fuels their business growth.

New Mortgage Company Marketing Ideas

Premiering innovative marketing ideas for mortgage experts like you, we’ve pinpointed five approaches to spark growth. Jot down the playbook essentials that can transform your digital footprint today.

- Create a referral program that rewards clients for sending new business your way.

- Partner with local influencers (like real estate bloggers or personal finance experts) to create sponsored content and reach a new audience.

- Develop a mobile app that helps clients calculate mortgage payments, compare loan options, and apply for financing on-the-go.

- Host a virtual summit or webinar series that showcases your expertise and provides valuable insights for potential clients.

How Much Should Mortgage Marketing Cost?

The cost of marketing for mortgage companies can vary widely depending on your goals, target audience, and chosen tactics. As a general rule of thumb, most businesses allocate 7-10% of their revenue to marketing.

You invest in stocks, bonds, and real estate – so why not invest in your marketing? Ditch expensive tactics and redirect your budget to those that yield the best returns.

What is the Typical Cost Per Lead and Conversion Rate a Mortgage Company Can Expect?

The cost per lead and conversion rate for mortgage lenders can also vary widely depending on factors like your market, competition, and lead quality. According to a recent study by Inman, the average cost per lead for mortgage lenders is around $100, with a conversion rate of 2-5%.

The proof is in the pudding – or in this case, the metrics. Let data guide your marketing decisions and continuously refine your strategy to achieve the best possible outcomes.

Download Our “How to Implement SEO for Lenders” eBook!

SEO for Mortgage Companies

Driving traffic to your website is crucial for mortgage lenders, but getting the right people there is what really matters. By optimizing your website and online content with relevant keywords, you can appeal to the people who matter most – your target audience.

What is a Content Management System?

Mortgage lenders, ready to share your expertise with the world? Finding a user-friendly platform to manage and publish your online content shouldn’t be a challenge. Luckily, there are a range of content management systems (CMS) designed to help you effortlessly create, manage, and publish your website’s content, no coding skills required. Options like WordPress, Squarespace, and Wix are popular among mortgage companies, making it easy to get your message out to potential clients. (If you’re on WordPress, RankWriters makes it easy for your blog content to automatically sync!)

When choosing a CMS for your mortgage website, look for a platform that is user-friendly, customizable, and optimized for search engines. You’ll also want to consider factors like security, support, and integrations with other marketing tools.

Local SEO for Mortgage Lenders

For mortgage lenders looking to attract more clients, local SEO is a must-have. When potential clients search for mortgage services, they’re usually looking for ones that serve their specific area, so it’s vital to optimize your online presence for local keywords.

Tired of struggling to get found online? Mortgage lenders who want to stay ahead of the competition need to master some local SEO strategies. By doing so, they can increase their visibility and reach more customers.

- Claiming and optimizing your Google My Business listing.

- Building local citations (like directory listings and online profiles).

- Encouraging satisfied clients to leave online reviews.

- Creating location-specific website content (like blog posts or landing pages).

Get specific about your target audience and design marketing strategies that resonate with them, such as creating engaging content, running targeted ads, and partnering with local real estate agents to host seminars.

Conclusion

Mortgage marketing is an ever-evolving landscape that requires adaptability, creativity, and a deep understanding of your target audience. By implementing a well-rounded marketing strategy that encompasses both traditional and digital channels, you can effectively reach potential borrowers and establish yourself as a trusted resource in the mortgage industry.

In recent years, mortgage borrowers deserve higher expectations in interaction with lending specialists – including those in real estate transactions. High expectations hinge on unwavering excellence: knowledge accuracy, authentic human engagement, and timely personalized advice.

So, whether you’re a seasoned loan officer or just starting out in the world of mortgage lending, embrace the power of effective mortgage marketing. With dedication, persistence, and a commitment to serving your clients’ needs, you can unlock the full potential of your mortgage business and achieve long-term success in this dynamic and rewarding industry.